Question: A firm which is self-constructing a new factory has correctly calculated Avoidable Interest for the year of $100,000. The entire amount of the Weighted

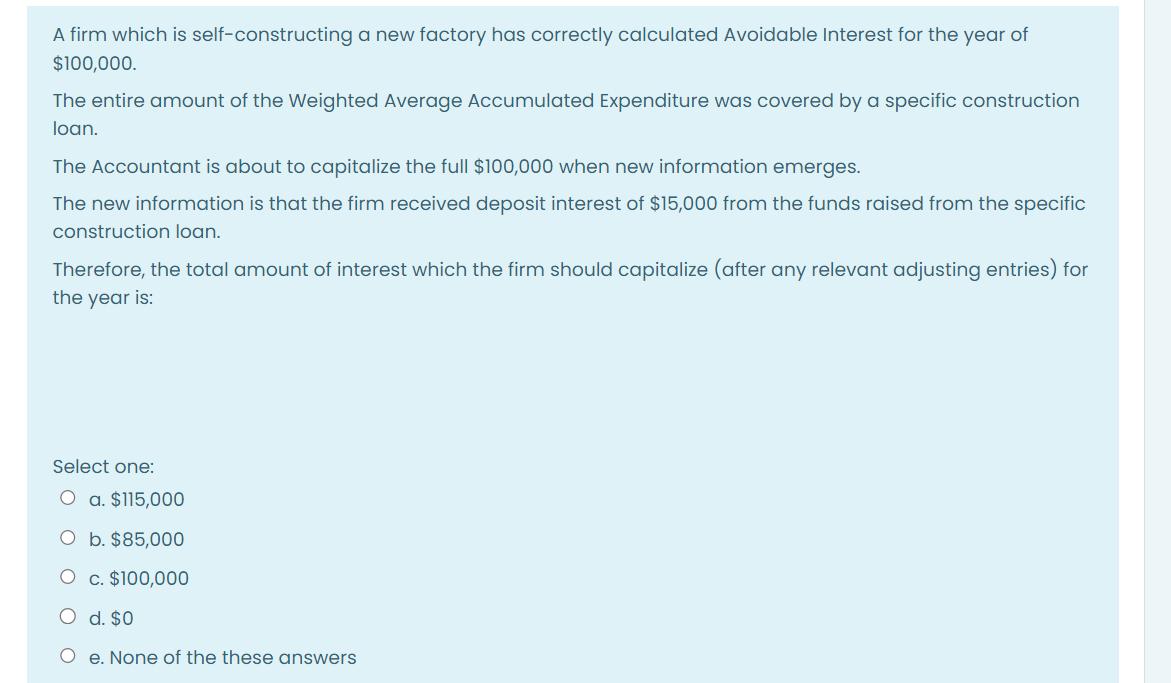

A firm which is self-constructing a new factory has correctly calculated Avoidable Interest for the year of $100,000. The entire amount of the Weighted Average Accumulated Expenditure was covered by a specific construction loan. The Accountant is about to capitalize the full $100,000 when new information emerges. The new information is that the firm received deposit interest of $15,000 from the funds raised from the specific construction loan. Therefore, the total amount of interest which the firm should capitalize (after any relevant adjusting entries) for the year is: Select one: O a. $115,000 O b. $85,000 O c. $100,000 O d. $0 O e. None of the these answers A firm which is self-constructing a new factory has correctly calculated Avoidable Interest for the year of $100,000. The entire amount of the Weighted Average Accumulated Expenditure was covered by a specific construction loan. The Accountant is about to capitalize the full $100,000 when new information emerges. The new information is that the firm received deposit interest of $15,000 from the funds raised from the specific construction loan. Therefore, the total amount of interest which the firm should capitalize (after any relevant adjusting entries) for the year is: Select one: O a. $115,000 O b. $85,000 O c. $100,000 O d. $0 O e. None of the these answers

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below To determine th... View full answer

Get step-by-step solutions from verified subject matter experts