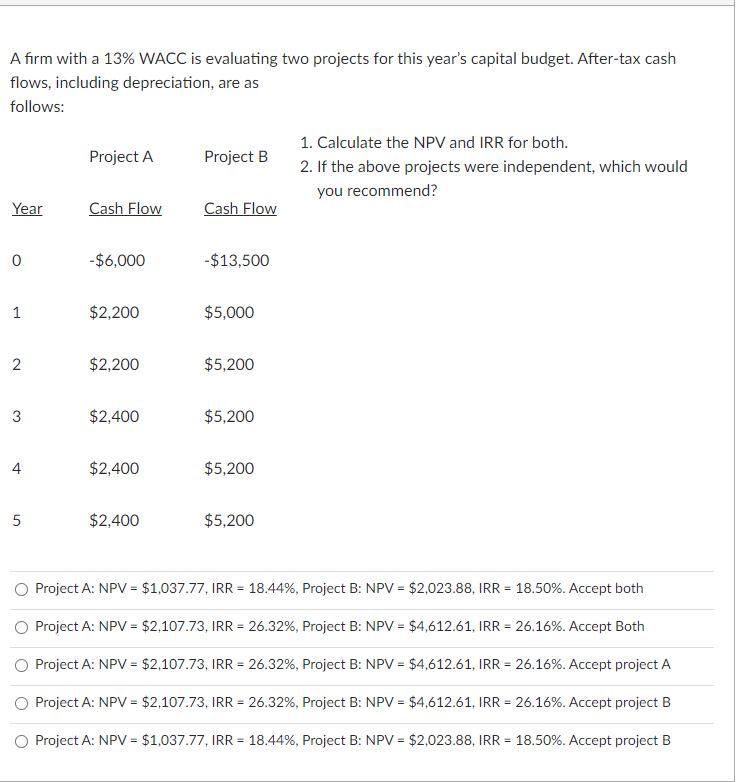

Question: A firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: Project A

A firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: Project A Project B 1. Calculate the NPV and IRR for both. 2. If the above projects were independent, which would you recommend? Year Cash Flow Cash Flow 0 -$6,000 -$13,500 1 $2,200 $5,000 2 $2,200 $5,200 3 $2,400 $5,200 $2,400 $5,200 5 $2,400 $5,200 Project A: NPV = $1,037.77, IRR = 18.44%, Project B: NPV = $2,023.88, IRR = 18.50%. Accept both Project A: NPV = $2,107.73, IRR = 26.32%, Project B: NPV = $4.612.61, IRR = 26.16%. Accept Both Project A: NPV = $2,107.73. IRR = 26.32%, Project B: NPV = $4.612.61, IRR = 26.16%. Accept project A O Project A: NPV = $2,107.73, IRR = 26.32%, Project B: NPV = $4,612.61, IRR = 26.16%. Accept project B Project A: NPV = $1,037.77, IRR = 18.44%, Project B: NPV = $2,023.88, IRR = 18.50%. Accept project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts