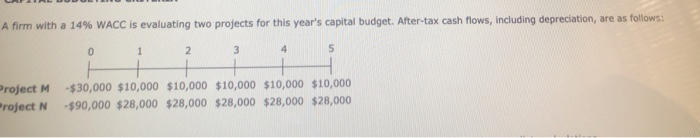

Question: A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: Project M

A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: Project M $30,000 $10,000 $10,000 $10,000 $10,000 $10,000 roject N $90,000 $28,000 $28,000 $28,000 $28,000 $28,000 You are giving a 30-minute presentation to upper management at your company. Which of the following should you write out and rehearse extensively before speaking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts