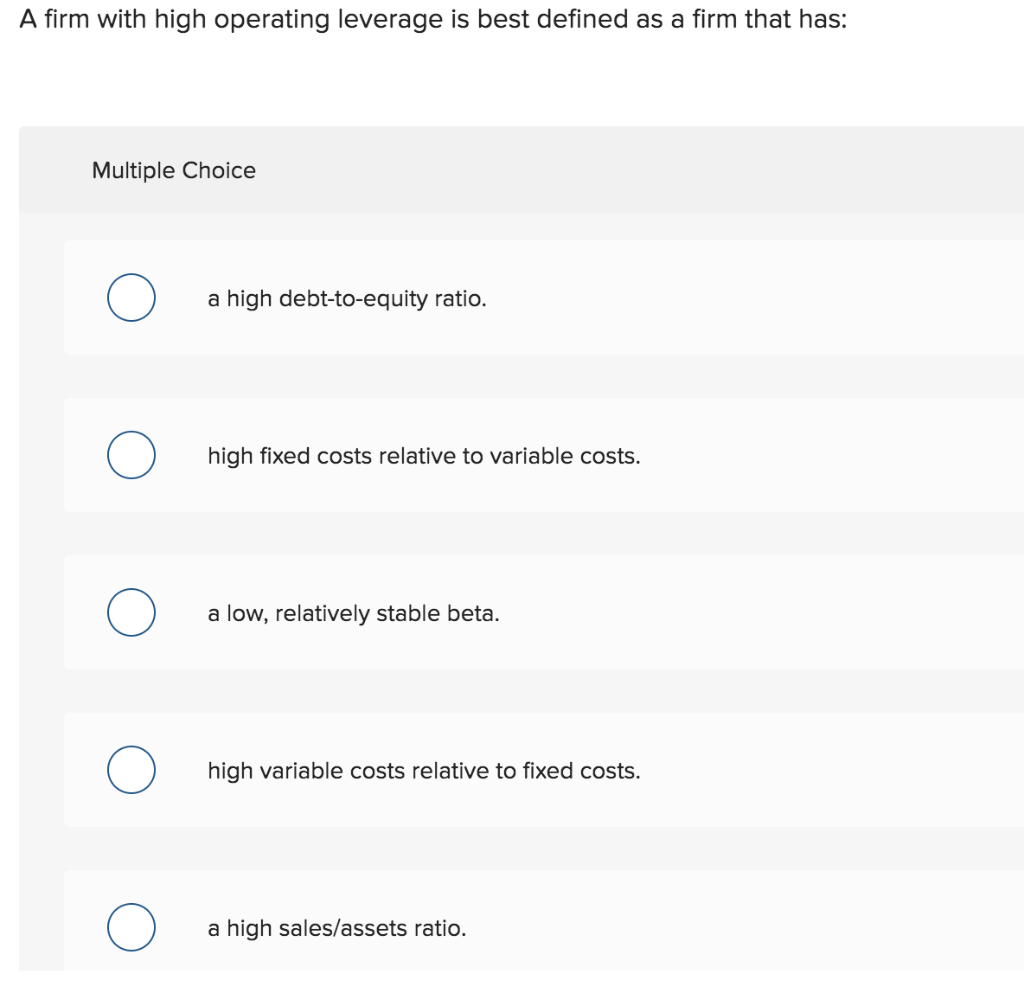

Question: A firm with high operating leverage is best defined as a firm that has: Multiple Choice a high debt-to-equity ratio. high fixed costs relative to

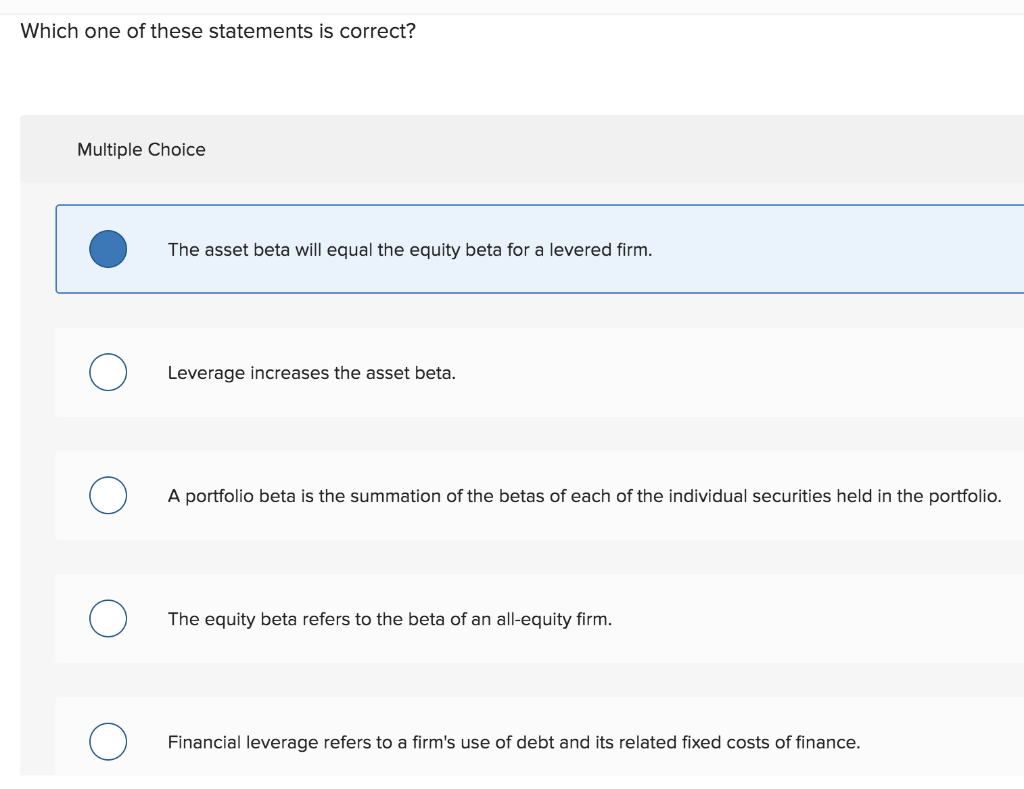

A firm with high operating leverage is best defined as a firm that has: Multiple Choice a high debt-to-equity ratio. high fixed costs relative to variable costs. O a low, relatively stable beta. O high variable costs relative to fixed costs. O a high sales/assets ratio. Which one of these statements is correct? Multiple Choice The asset beta will equal the equity beta for a levered firm. Leverage increases the asset beta. o A portfolio beta is the summation of the betas of each of the individual securities held in the portfolio. o The equity beta refers to the beta of an all-equity firm. o o Financial leverage refers to a firm's use of debt and its related fixed costs of finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts