Question: A- First box- discount or premium second box-lower or higher Third box-appreciation, depreciation or no change B- First box-appreciation, depreciation or no change second box-

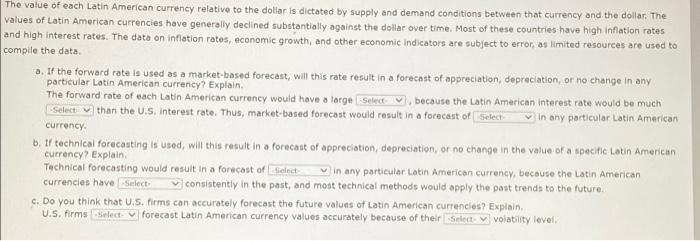

The value of each Latin American currency relative to the dollar is dictated by supply and demand conditions between that currency and the dollar. The values of Latin American currencies have generally declined substantially against the dollar over time. Most of these countries have high inflation rates and high interest rates. The data on inflation rates, economic growth, and other economic indicators are subject to error, os limited resources are used to compile the data a. If the forward rate is used as a market-based forecast, will this rate result in a forecast of appreciation, depreciation, or no change in any particular Latin American currency? Explain. The forward rate of each Latin American currency would have a large select because the Latin American interest rate would be much Select than the U.S. Interest rate. Thus, market-based forecast would result in a forecast of Select v in any particular Latin American currency b. If technical forecasting is used, will this result in a forecast of appreciation, depreciation, or no change in the value of a specific Latin American currency? Explain Technical forecasting would result in a forecast of select in any particular Latin American currency, because the Latin American v consistently in the past, and most technical methods would apply the post trends to the future C. Do you think that U.S. Pirms can accurately forecast the future values of Latin American currencies? Explain, U.S. firms Select M forecast Latin American currency values accurately because of their Select volatility level currencies have Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts