Question: A first - year co - op student is trying to determine the amount of cash and cash equivalents that should be reported on a

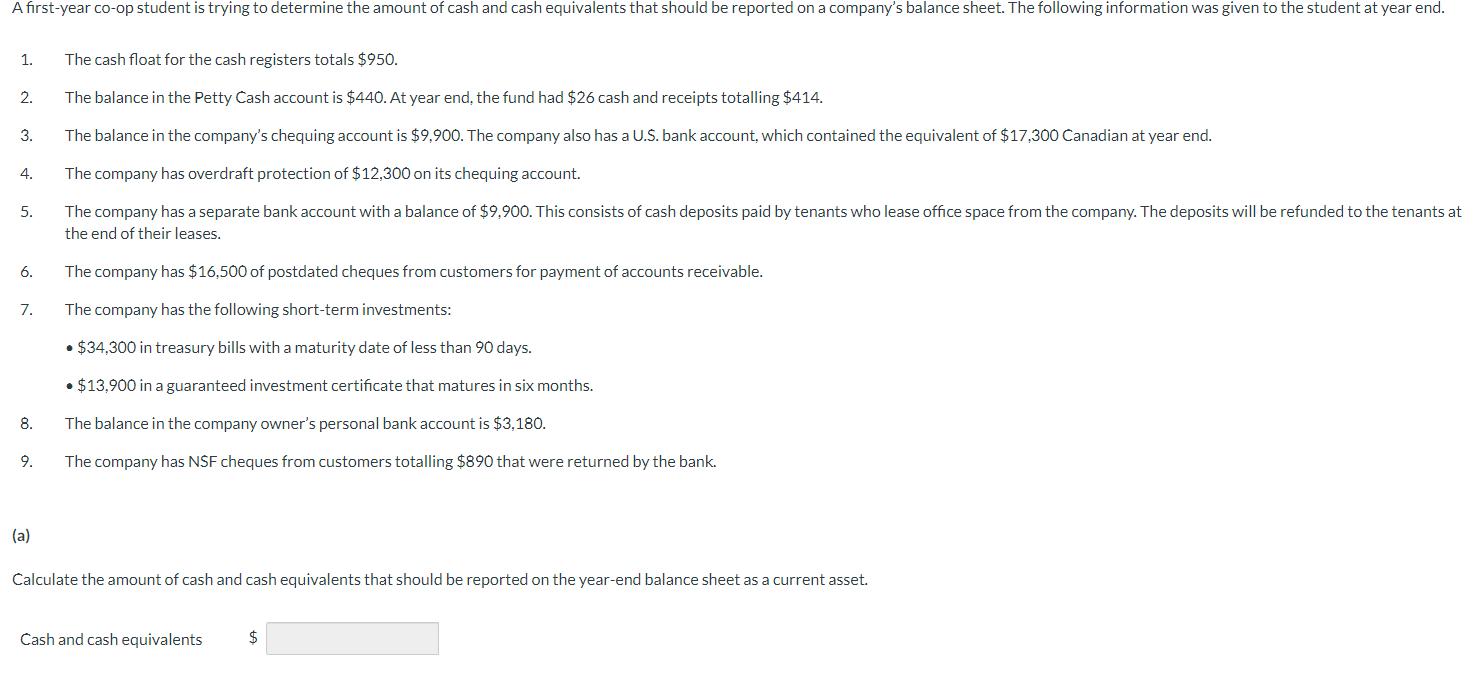

A firstyear coop student is trying to determine the amount of cash and cash equivalents that should be reported on a company's balance sheet. The following information was given to the student at year end.

The cash float for the cash registers totals $

The balance in the Petty Cash account is $ At year end, the fund had $ cash and receipts totalling $

The balance in the company's chequing account is $ The company also has a US bank account, which contained the equivalent of $ Canadian at year end.

The company has overdraft protection of $ on its chequing account.

the end of their leases.

The company has $ of postdated cheques from customers for payment of accounts receivable.

The company has the following shortterm investments:

$ in treasury bills with a maturity date of less than days.

$ in a guaranteed investment certificate that matures in six months.

The balance in the company owner's personal bank account is $

The company has NSF cheques from customers totalling $ that were returned by the bank.

a

Calculate the amount of cash and cash equivalents that should be reported on the yearend balance sheet as a current asset.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock