Question: A five-year 2.4% defaultable coupon bond is selling to yield 3% (Annual Percent Rate and semi- annual compounding). The bond pays interest semi-annually. The

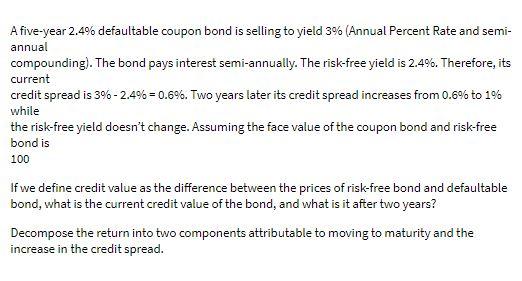

A five-year 2.4% defaultable coupon bond is selling to yield 3% (Annual Percent Rate and semi- annual compounding). The bond pays interest semi-annually. The risk-free yield is 2.4%. Therefore, its current credit spread is 3% - 2.4% = 0.6%. Two years later its credit spread increases from 0.6% to 1% while the risk-free yield doesn't change. Assuming the face value of the coupon bond and risk-free bond is 100 If we define credit value as the difference between the prices of risk-free bond and defaultable bond, what is the current credit value of the bond, and what is it after two years? Decompose the return into two components attributable to moving to maturity and the increase in the credit spread.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts