Question: A five-year, $3000 note bearing interest at 9% compounded annually was discounted at 10% compounded semi-annually yielding proceeds of $4396.07. How many months before the

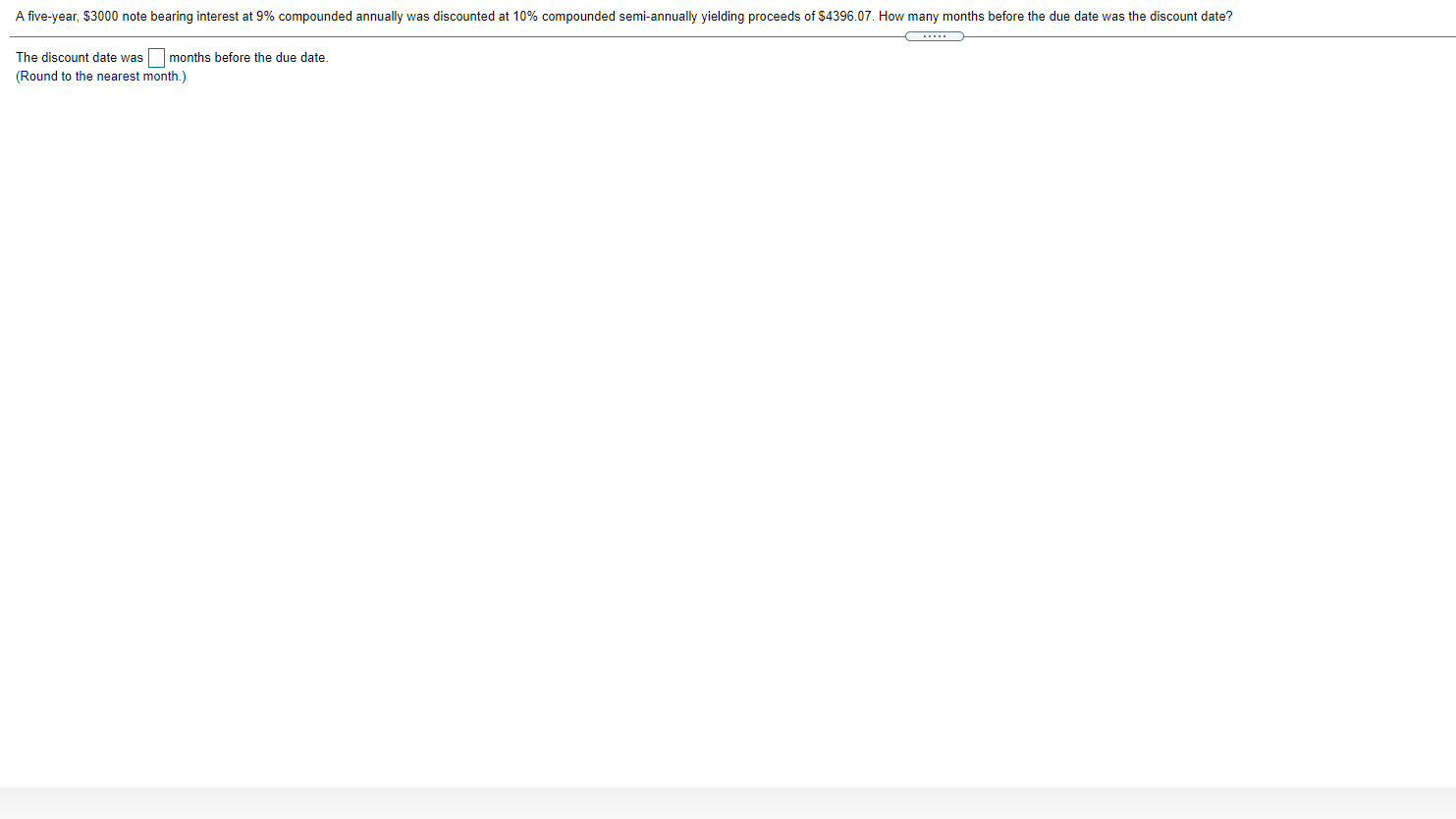

A five-year, $3000 note bearing interest at 9% compounded annually was discounted at 10% compounded semi-annually yielding proceeds of $4396.07. How many months before the due date was the discount date? .... The discount date was months before the due date. (Round to the nearest month.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts