Question: A five-year floating-rate note has coupons referenced to six-month dollar LIBOR, and pays coupon interest quarterly. Assume that the current LIBOR is 7 percent. If

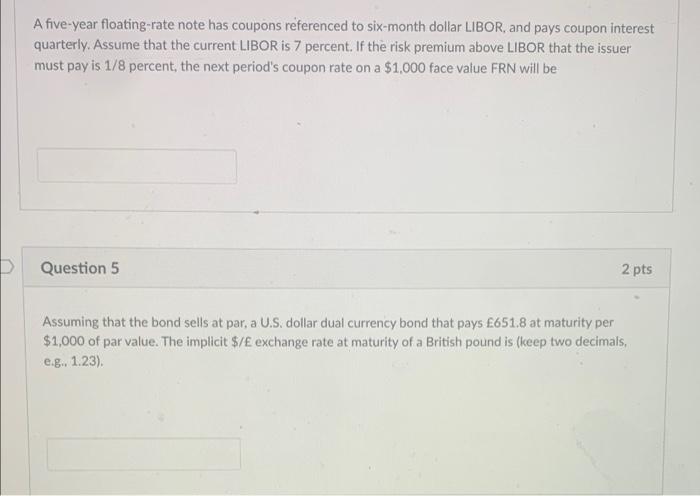

A five-year floating-rate note has coupons referenced to six-month dollar LIBOR, and pays coupon interest quarterly. Assume that the current LIBOR is 7 percent. If the risk premium above LIBOR that the issuer must pay is 1/8 percent, the next period's coupon rate on a $1,000 face value FRN will be Question 5 2 pts Assuming that the bond sells at par, a U.S. dollar dual currency bond that pays 651.8 at maturity per $1,000 of par value. The implicit $/ exchange rate at maturity of a British pound is (keep two decimals, e.g... 1.23)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts