Question: A fixed interest stock with an optional redemption date at any time between 3 and 11 years from the date of isssue is redeemable at

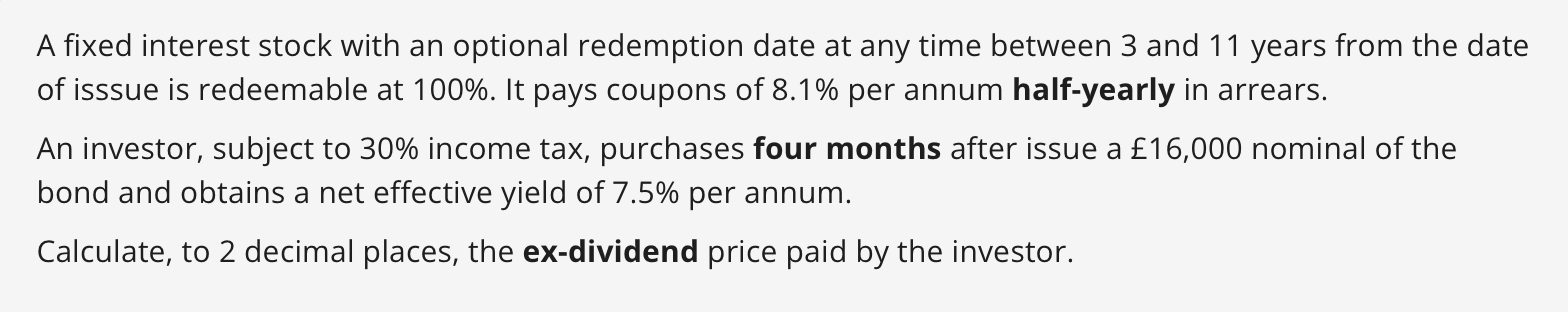

A fixed interest stock with an optional redemption date at any time between 3 and 11 years from the date of isssue is redeemable at 100%. It pays coupons of 8.1% per annum half-yearly in arrears. An investor, subject to 30% income tax, purchases four months after issue a 16,000 nominal of the bond and obtains a net effective yield of 7.5% per annum. Calculate, to 2 decimal places, the ex-dividend price paid by the investor. A fixed interest stock with an optional redemption date at any time between 3 and 11 years from the date of isssue is redeemable at 100%. It pays coupons of 8.1% per annum half-yearly in arrears. An investor, subject to 30% income tax, purchases four months after issue a 16,000 nominal of the bond and obtains a net effective yield of 7.5% per annum. Calculate, to 2 decimal places, the ex-dividend price paid by the investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts