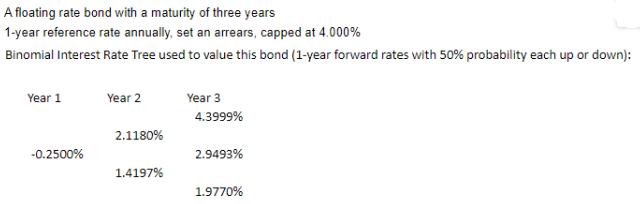

Question: A floating rate bond with a maturity of three years 1-year reference rate annually, set an arrears, capped at 4.000% Binomial Interest Rate Tree

A floating rate bond with a maturity of three years 1-year reference rate annually, set an arrears, capped at 4.000% Binomial Interest Rate Tree used to value this bond (1-year forward rates with 50% probability each up or down): Year 1 -0.2500% Year 2 2.1180% 1.4197% Year 3 4.3999% 2.9493% 1.9770% Find: The value of the Bond in % of par value to three decimal places. Please show work in excel format

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Lets break down the calculations in an Excel format Assuming the par value of the bond is 1000 the c... View full answer

Get step-by-step solutions from verified subject matter experts