Question: A forward contract is worth zero when it is first set up . When times go by , however, the forward contract may have a

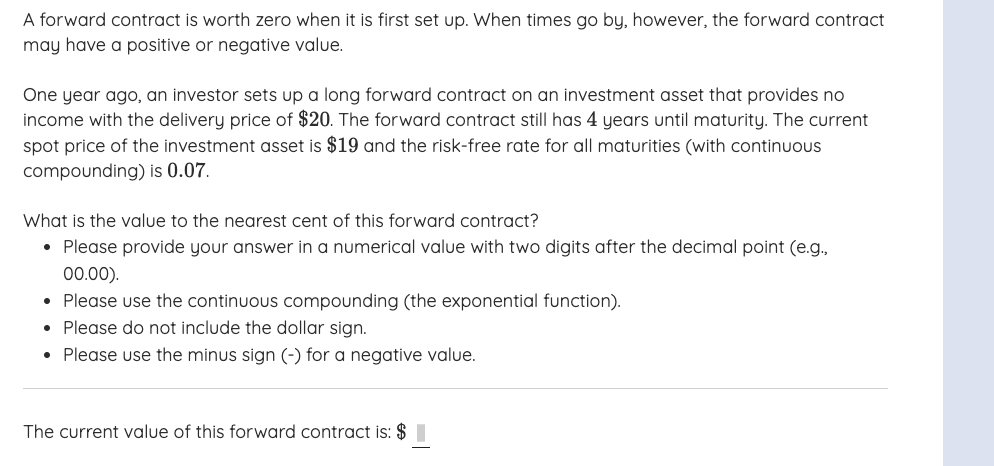

A forward contract is worth zero when it is first set up When times go by however, the forward contract

may have a positive or negative value.

One year ago, an investor sets up a long forward contract on an investment asset that provides no

income with the delivery price of $ The forward contract still has years until maturity. The current

spot price of the investment asset is $ and the riskfree rate for all maturities with continuous

compounding is

What is the value to the nearest cent of this forward contract?

Please provide your answer in a numerical value with two digits after the decimal point eg

Please use the continuous compounding the exponential function

Please do not include the dollar sign.

Please use the minus sign for a negative value.

The current value of this forward contract is: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock