Question: A. Four equity indices without a commodity (efficient frontier chart) B. Four equity indices with a commodity (efficient frontier chart) Questions: Write a recommendation regarding

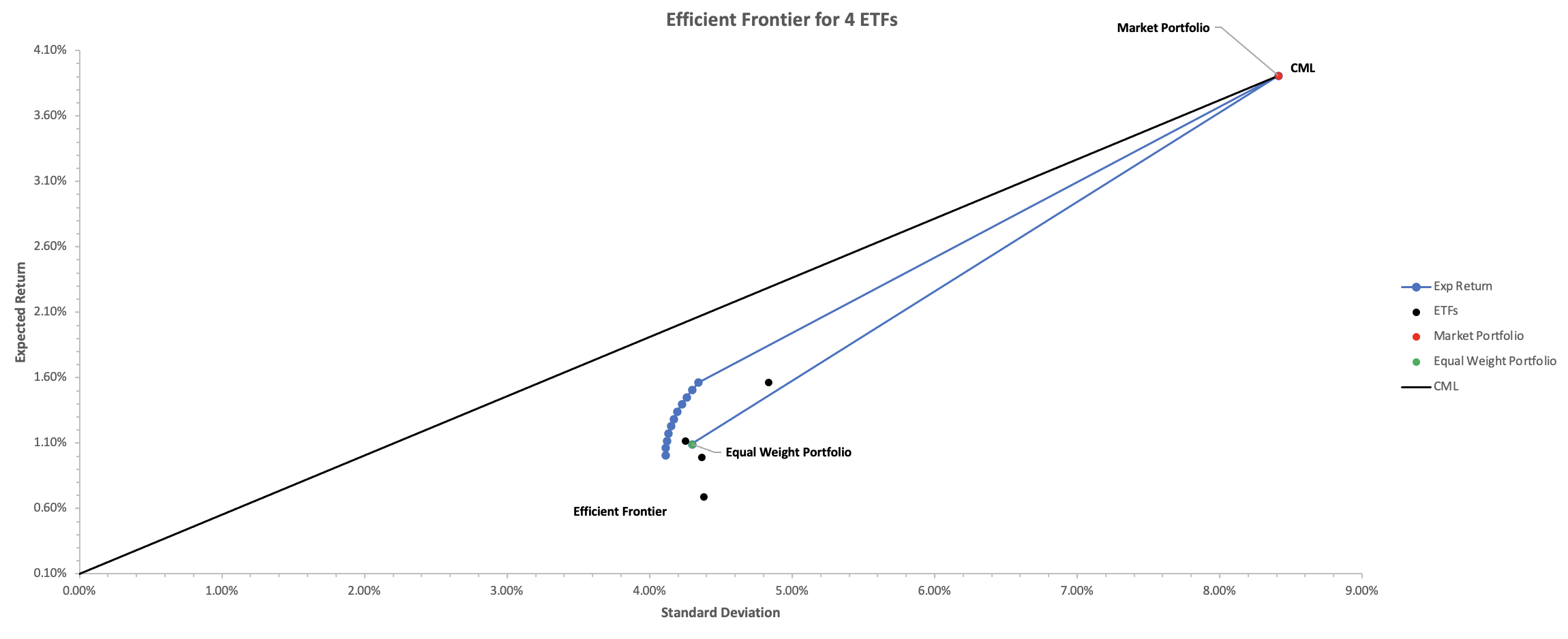

A. Four equity indices without a commodity (efficient frontier chart)

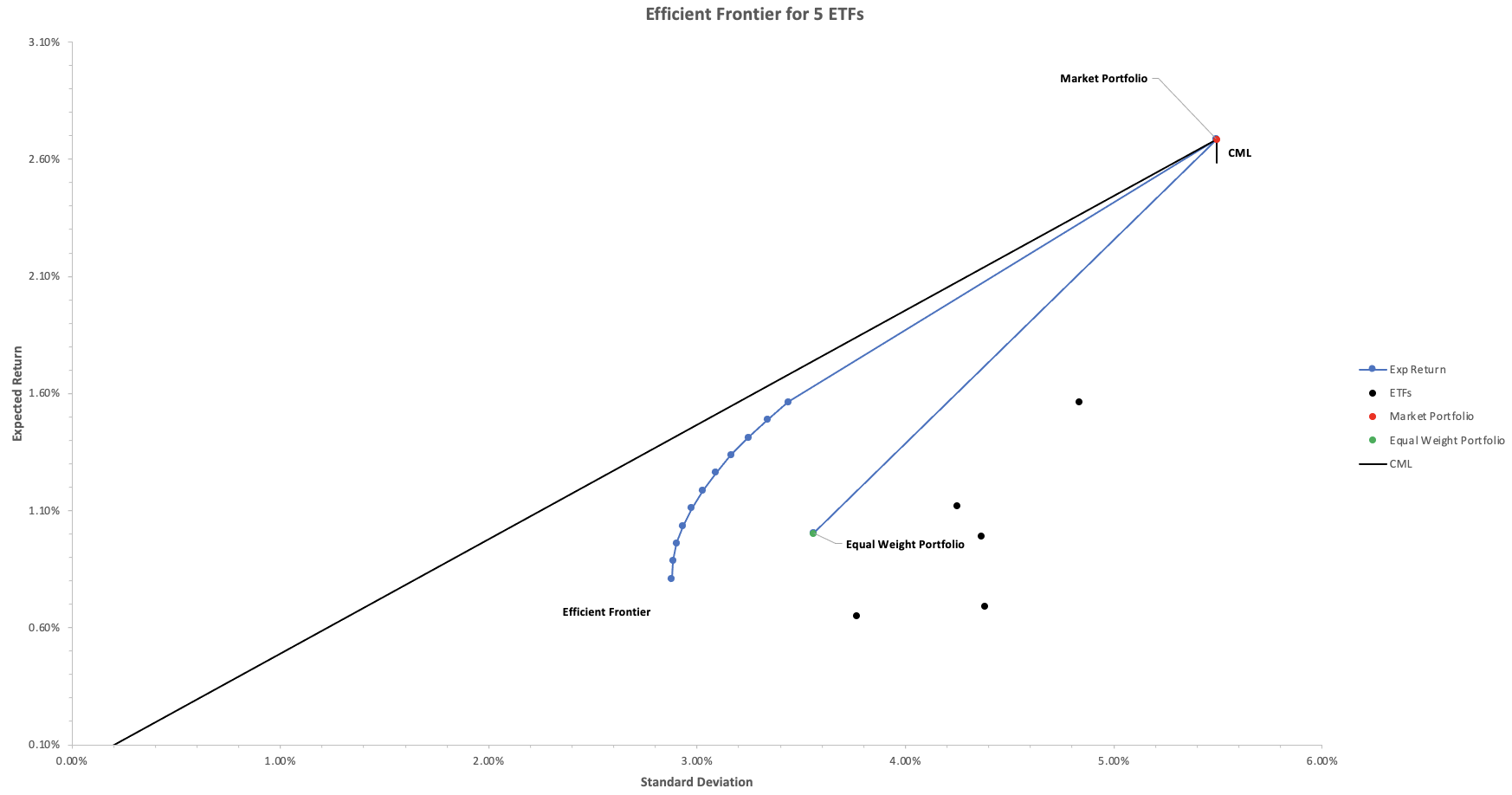

B. Four equity indices with a commodity (efficient frontier chart)

Questions:

- Write a recommendation regarding the commodity allocation of AI equity portfolio. Link your finding to some of the international literature on the contribution of commodities to equity portfolios.

Efficient Frontier for 4 ETFs Market Portfolio 4.10% CML 3.60% 3.10% 2.60% Exp Return Expected Return 2.10% ETFs . Market Portfolio . Equal Weight Portfolio 1.60% CML 1.10% Equal Weight Portfolio 0.60% Efficient Frontier 0.10% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% Standard Deviation Efficient Frontier for 5 ETFs 3.10% Market Portfolio 2.60% CML 2.10% Exp Return Expected Return 1.60% ETFs Market Portfolio . Equal Weight Portfolio -CML 1.10% Equal Weight Portfolio Efficient Frontier 0.60% 0.10% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Standard Deviation Efficient Frontier for 4 ETFs Market Portfolio 4.10% CML 3.60% 3.10% 2.60% Exp Return Expected Return 2.10% ETFs . Market Portfolio . Equal Weight Portfolio 1.60% CML 1.10% Equal Weight Portfolio 0.60% Efficient Frontier 0.10% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% Standard Deviation Efficient Frontier for 5 ETFs 3.10% Market Portfolio 2.60% CML 2.10% Exp Return Expected Return 1.60% ETFs Market Portfolio . Equal Weight Portfolio -CML 1.10% Equal Weight Portfolio Efficient Frontier 0.60% 0.10% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts