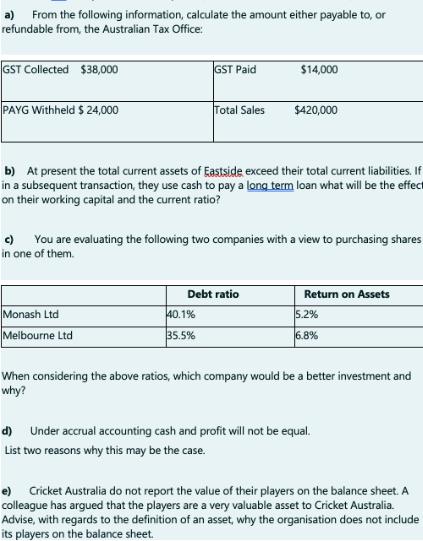

Question: a) From the following information, calculate the amount either payable to, or refundable from, the Australian Tax Office: GST Collected $38,000 PAYG Withheld $

a) From the following information, calculate the amount either payable to, or refundable from, the Australian Tax Office: GST Collected $38,000 PAYG Withheld $ 24,000 GST Paid Monash Ltd Melbourne Ltd Total Sales b) At present the total current assets of Eastside exceed their total current liabilities. If in a subsequent transaction, they use cash to pay a long term loan what will be the effect on their working capital and the current ratio? 40.1% 35.5% $14,000 c) You are evaluating the following two companies with a view to purchasing shares in one of them. Debt ratio $420,000 Return on Assets 5.2% 6.8% When considering the above ratios, which company would be a better investment and why? d) Under accrual accounting cash and profit will not be equal. List two reasons why this may be the case. e) Cricket Australia do not report the value of their players on the balance sheet. A colleague has argued that the players are a very valuable asset to Cricket Australia. Advise, with regards to the definition of an asset, why the organisation does not include its players on the balance sheet.

Step by Step Solution

3.29 Rating (146 Votes )

There are 3 Steps involved in it

a GST payable to ATO GST Collected GST Paid 38000 14000 24000 Net amount payable to ATO GST payable ... View full answer

Get step-by-step solutions from verified subject matter experts