Question: A Fund is set up to charge a load. Its net asset value is GHS 16.50 and its offer price is GHS17.30. e. By what

A Fund is set up to charge a load. Its net asset value is GHS 16.50 and its offer price is GHS17.30.

e. By what percentage would the net asset value of the shares have to increase for you to break even?

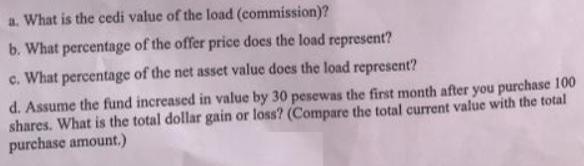

a. What is the cedi value of the load (commission)? b. What percentage of the offer price does the load represent? c. What percentage of the net asset value does the load represent? d. Assume the fund increased in value by 30 pesewas the first month after you purchase 100 shares. What is the total dollar gain or loss? (Compare the total current value with the total purchase amount,.)

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

The cedi value of load commission Offer priceNet asset value 17301650 GHS080 b o... View full answer

Get step-by-step solutions from verified subject matter experts