Question: A fund manager has a portfolio whose current value is $12 million and a beta of 1.18. She expects the market to be rather volatile

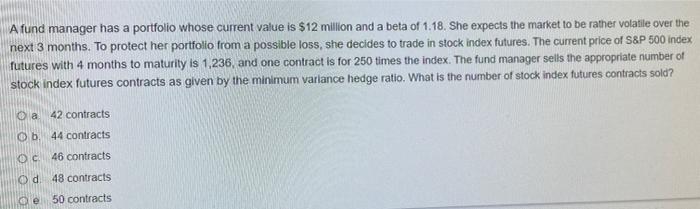

A fund manager has a portfolio whose current value is $12 million and a beta of 1.18. She expects the market to be rather volatile over the next 3 months. To protect her portfolio from a possible loss, she decides to trade in stock index futures. The current price of S&P 500 index futures with 4 months to maturity is 1,236, and one contract is for 250 times the index. The fund manager sells the appropriate number of stock index futures contracts as given by the minimum varlance hedge ratio. What is the number of stock index futures contracts sold? O a 42 contracts Ob.44 contracts 46 contracts Od 48 contracts De 50 contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts