Question: A German importer has entered into a contract under which it will require payment in GBP in one month. The company is concerned at

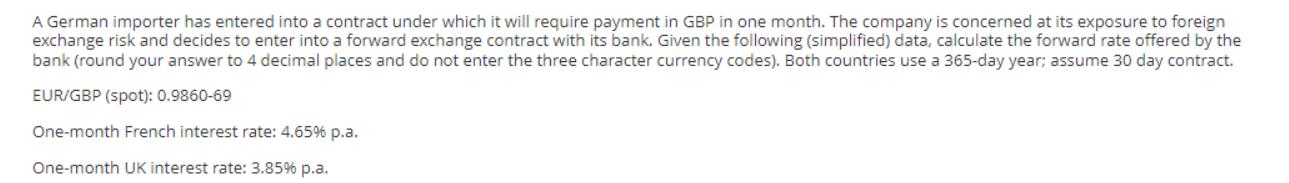

A German importer has entered into a contract under which it will require payment in GBP in one month. The company is concerned at its exposure to foreign exchange risk and decides to enter into a forward exchange contract with its bank. Given the following (simplified) data, calculate the forward rate offered by the bank (round your answer to 4 decimal places and do not enter the three character currency codes). Both countries use a 365-day year; assume 30 day contract. EUR/GBP (spot): 0.9860-69 One-month French interest rate: 4.65% p.a. One-month UK interest rate: 3.85% p.a. What is the future value in four-and-a-half years of $8000 invested today at 4.21% compounded semi-annually?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts