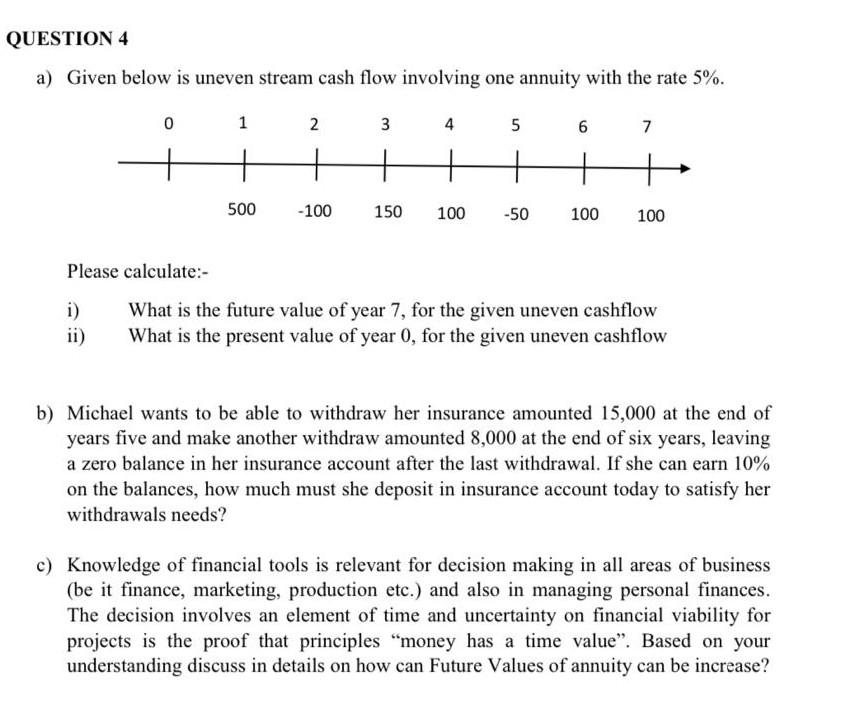

Question: a) Given below is uneven stream cash flow involving one annuity with the rate 5%. Please calculate:- i) What is the future value of year

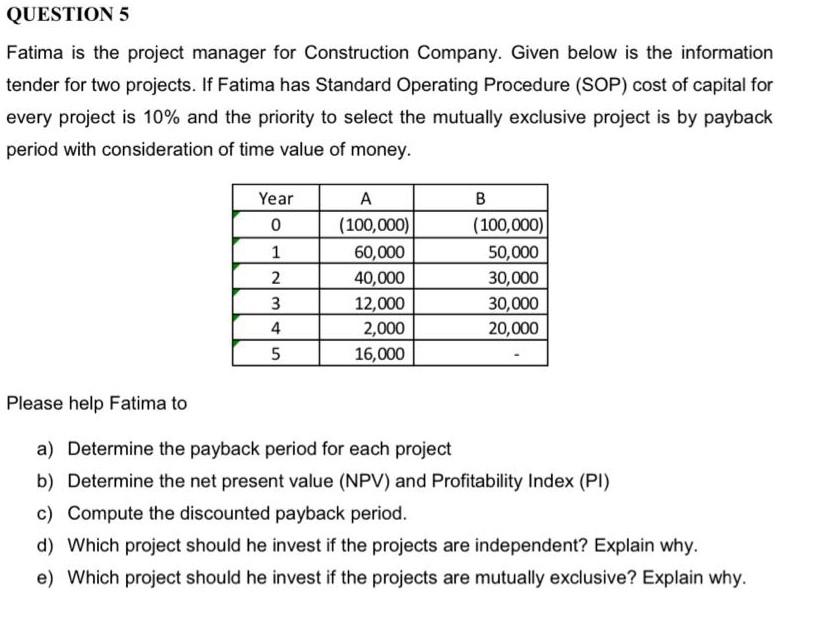

a) Given below is uneven stream cash flow involving one annuity with the rate 5%. Please calculate:- i) What is the future value of year 7 , for the given uneven cashflow ii) What is the present value of year 0 , for the given uneven cashflow b) Michael wants to be able to withdraw her insurance amounted 15,000 at the end of years five and make another withdraw amounted 8,000 at the end of six years, leaving a zero balance in her insurance account after the last withdrawal. If she can earn 10\% on the balances, how much must she deposit in insurance account today to satisfy her withdrawals needs? c) Knowledge of financial tools is relevant for decision making in all areas of business (be it finance, marketing, production etc.) and also in managing personal finances. The decision involves an element of time and uncertainty on financial viability for projects is the proof that principles "money has a time value". Based on your understanding discuss in details on how can Future Values of annuity can be increase? Fatima is the project manager for Construction Company. Given below is the information tender for two projects. If Fatima has Standard Operating Procedure (SOP) cost of capital for every project is 10% and the priority to select the mutually exclusive project is by payback period with consideration of time value of money. Please help Fatima to a) Determine the payback period for each project b) Determine the net present value (NPV) and Profitability Index (PI) c) Compute the discounted payback period. d) Which project should he invest if the projects are independent? Explain why. e) Which project should he invest if the projects are mutually exclusive? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts