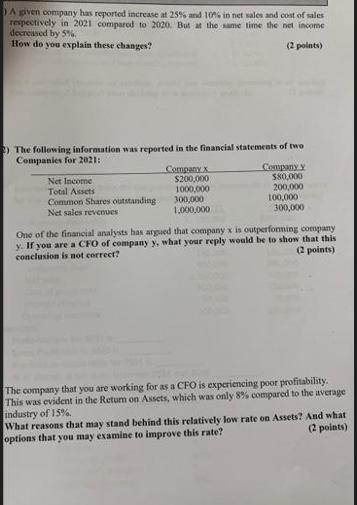

Question: A given company has reported increase at 25% and 10% in net sales and cost of sales respectively in 2021 compared to 2020. But

A given company has reported increase at 25% and 10% in net sales and cost of sales respectively in 2021 compared to 2020. But at the same time the net income decreased by 5%. How do you explain these changes? (2 points) 2) The following information was reported in the financial statements of two Companies for 2021: Net Income Total Assets Common Shares outstanding - Net sales revenues Company x $200,000 1000,000 300,000 1,000,000 Company y $80,000 200,000 100,000 300,000 One of the financial analysts has argued that company x is outperforming company y. If you are a CFO of company y, what your reply would be to show that this (2 points) conclusion is not correct? The company that you are working for as a CFO is experiencing poor profitability. This was evident in the Retum on Assets, which was only 8% compared to the average industry of 15% What reasons that may stand behind this relatively low rate on Assets? And what (2 points) options that you may examine to improve this rate?

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts