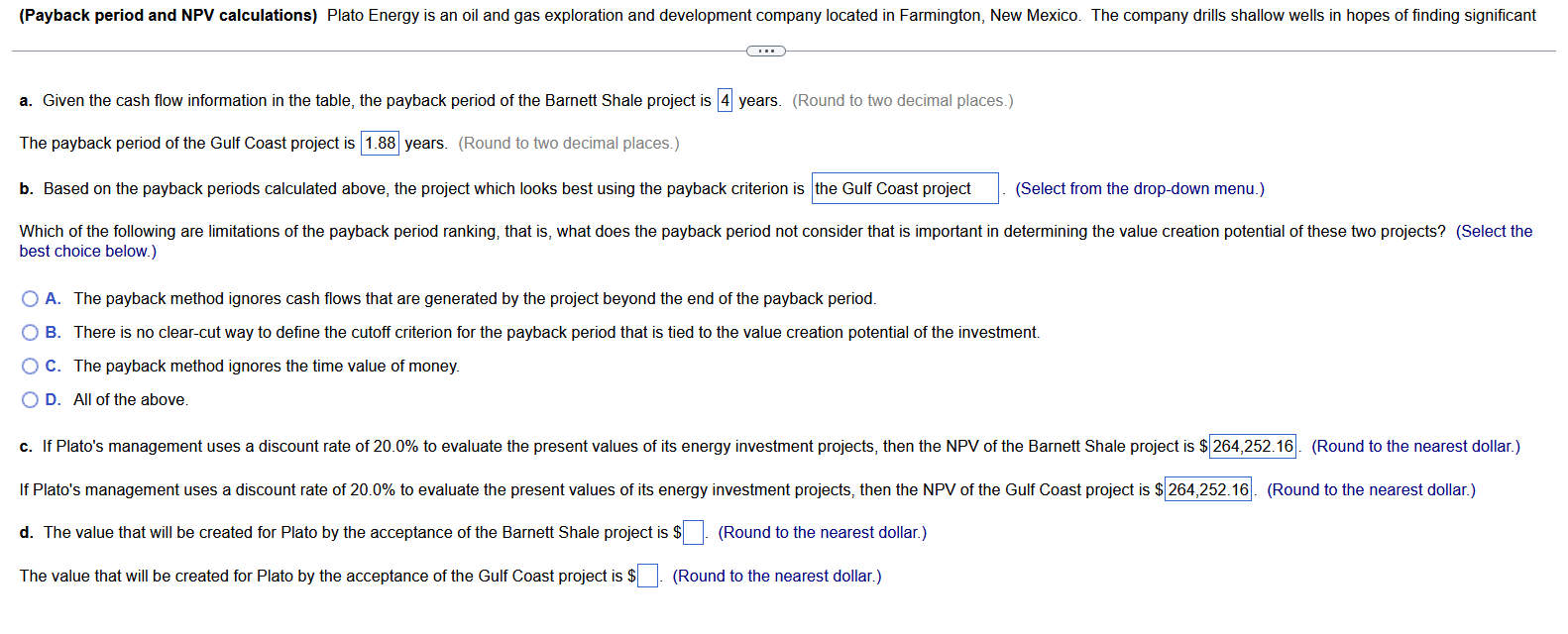

Question: a. Given the cash flow information in the table, the payback period of the Barnett Shale project is 4 years. (Round to two decimal places.)

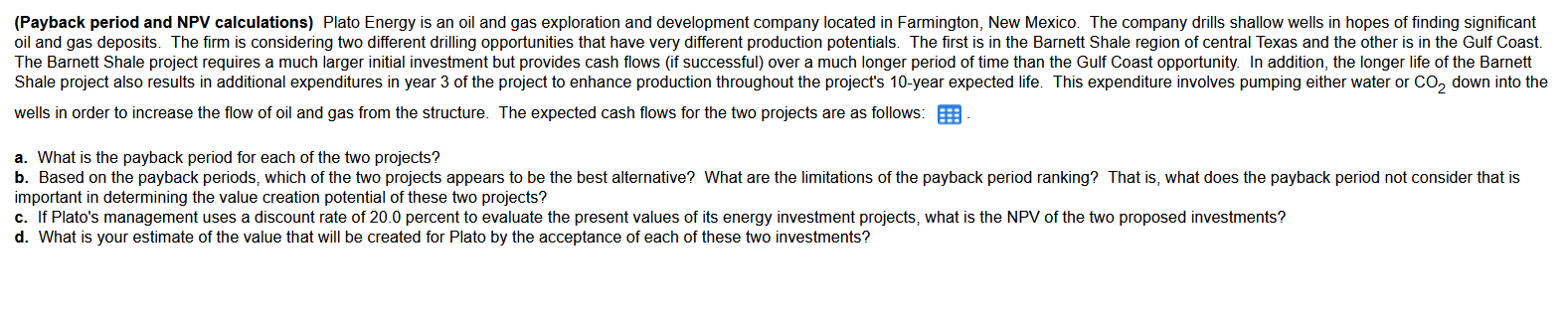

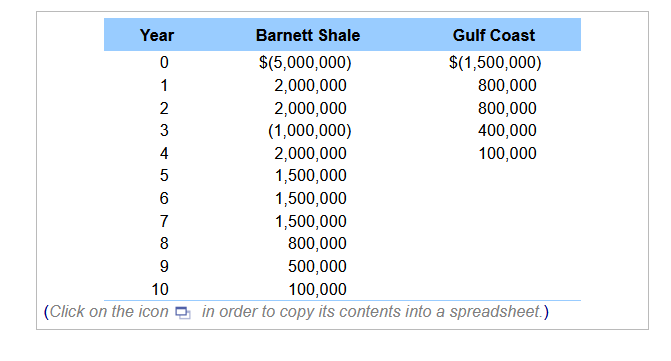

a. Given the cash flow information in the table, the payback period of the Barnett Shale project is 4 years. (Round to two decimal places.) The payback period of the Gulf Coast project is years. (Round to two decimal places.) b. Based on the payback periods calculated above, the project which looks best using the payback criterion is (Select from the drop-down menu.) best choice below.) A. The payback method ignores cash flows that are generated by the project beyond the end of the payback period. B. There is no clear-cut way to define the cutoff criterion for the payback period that is tied to the value creation potential of the investment. C. The payback method ignores the time value of money. D. All of the above. c. If Plato's management uses a discount rate of 20.0% to evaluate the present values of its energy investment projects, then the NPV of the Barnett Shale project is ? (Round to the nearest dollar.) If Plato's management uses a discount rate of 20.0% to evaluate the present values of its energy investment projects, then the NPV of the Gulf Coast project is : (Round to the nearest dollar.) d. The value that will be created for Plato by the acceptance of the Barnett Shale project is $ (Round to the nearest dollar.) (R) The value that will be created for Plato by the acceptance of the Gulf Coast project is $ (Round to the nearest dollar.) wells in order to increase the flow of oil and gas from the structure. The expected cash flows for the two projects are as follows: . a. What is the payback period for each of the two projects? important in determining the value creation potential of these two projects? c. If Plato's management uses a discount rate of 20.0 percent to evaluate the present values of its energy investment projects, what is the NPV of the two proposed investments? d. What is your estimate of the value that will be created for Plato by the acceptance of each of these two investments? \begin{tabular}{|ccc|} \hline Year & Barnett Shale & Gulf Coast \\ 0 & $(5,000,000) & $(1,500,000) \\ 1 & 2,000,000 & 800,000 \\ 2 & 2,000,000 & 800,000 \\ 3 & (1,000,000) & 400,000 \\ 4 & 2,000,000 & 100,000 \\ 5 & 1,500,000 & \\ 6 & 1,500,000 & \\ 7 & 1,500,000 & \\ 8 & 800,000 & \\ 9 & 500,000 & \\ 10 & 100,000 & \\ (Click on the icon & in order to copy its contents into a spreadsheet.) \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts