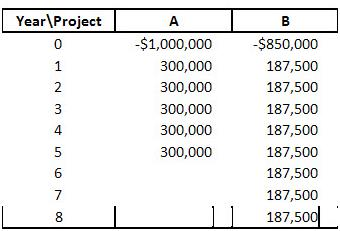

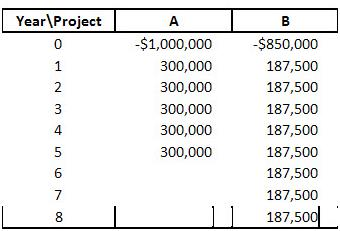

Question: a. Given the following cash flows for two mutually exclusive projects (A and B), which project should be chosen? Assume that the required rate of

a. Given the following cash flows for two mutually exclusive projects (A and B), which project should be chosen? Assume that the required rate of return of both projects is 10%. (Hint: Use EAC.)  b. A firm is considering the purchase of equipment which will cost $1 million. This equipment will last for seven years, at the end of which it can be sold for $100,000. The CCA rate for this asset class is 30%, and the firm expects to have other assets in this asset class at the end of year 7. This equipment is expected to increase before-tax operating cash flows by $303,030 per year. However, in order to put the equipment to use, an additional $150,000 will need to be invested in net working capital initially (i.e., at t=0). The required rate of return is 15% and the firms marginal tax rate is 34%. Should the firm purchase this equipment? c. Suppose that to arrive at the before-tax operating cash flows in part (b), we have used the following estimates: Fixed costs = $96,970 Variable costs = 60% of sales What is the Net Present Value of the new equipment if, in the best-case scenario, we estimate that fixed costs could be lower by 10% and sales revenues could be higher by 30%? d. Given the information in (b), and assuming that fixed costs are $96,970 and variables costs are 60% of sales, what is the sales level at which Net Present Value equals zero? (I.e., what is the financial break-even sales level?)

b. A firm is considering the purchase of equipment which will cost $1 million. This equipment will last for seven years, at the end of which it can be sold for $100,000. The CCA rate for this asset class is 30%, and the firm expects to have other assets in this asset class at the end of year 7. This equipment is expected to increase before-tax operating cash flows by $303,030 per year. However, in order to put the equipment to use, an additional $150,000 will need to be invested in net working capital initially (i.e., at t=0). The required rate of return is 15% and the firms marginal tax rate is 34%. Should the firm purchase this equipment? c. Suppose that to arrive at the before-tax operating cash flows in part (b), we have used the following estimates: Fixed costs = $96,970 Variable costs = 60% of sales What is the Net Present Value of the new equipment if, in the best-case scenario, we estimate that fixed costs could be lower by 10% and sales revenues could be higher by 30%? d. Given the information in (b), and assuming that fixed costs are $96,970 and variables costs are 60% of sales, what is the sales level at which Net Present Value equals zero? (I.e., what is the financial break-even sales level?)

b. A firm is considering the purchase of equipment which will cost $1 million. This equipment will last for seven years, at the end of which it can be sold for $100,000. The CCA rate for this asset class is 30%, and the firm expects to have other assets in this asset class at the end of year 7. This equipment is expected to increase before-tax operating cash flows by $303,030 per year. However, in order to put the equipment to use, an additional $150,000 will need to be invested in net working capital initially (i.e., at t=0). The required rate of return is 15% and the firms marginal tax rate is 34%. Should the firm purchase this equipment? c. Suppose that to arrive at the before-tax operating cash flows in part (b), we have used the following estimates: Fixed costs = $96,970 Variable costs = 60% of sales What is the Net Present Value of the new equipment if, in the best-case scenario, we estimate that fixed costs could be lower by 10% and sales revenues could be higher by 30%? d. Given the information in (b), and assuming that fixed costs are $96,970 and variables costs are 60% of sales, what is the sales level at which Net Present Value equals zero? (I.e., what is the financial break-even sales level?)

b. A firm is considering the purchase of equipment which will cost $1 million. This equipment will last for seven years, at the end of which it can be sold for $100,000. The CCA rate for this asset class is 30%, and the firm expects to have other assets in this asset class at the end of year 7. This equipment is expected to increase before-tax operating cash flows by $303,030 per year. However, in order to put the equipment to use, an additional $150,000 will need to be invested in net working capital initially (i.e., at t=0). The required rate of return is 15% and the firms marginal tax rate is 34%. Should the firm purchase this equipment? c. Suppose that to arrive at the before-tax operating cash flows in part (b), we have used the following estimates: Fixed costs = $96,970 Variable costs = 60% of sales What is the Net Present Value of the new equipment if, in the best-case scenario, we estimate that fixed costs could be lower by 10% and sales revenues could be higher by 30%? d. Given the information in (b), and assuming that fixed costs are $96,970 and variables costs are 60% of sales, what is the sales level at which Net Present Value equals zero? (I.e., what is the financial break-even sales level?)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock