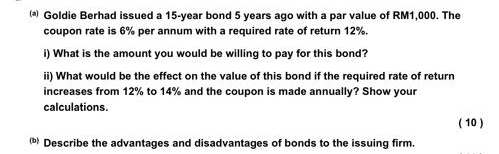

Question: ( a ) Goldie Berhad issued a 1 5 - year bond 5 years ago with a par value of RM 1 , 0 0

a Goldie Berhad issued a year bond years ago with a par value of RM The coupon rate is per annum with a required rate of return

i What is the amount you would be willing to pay for this bond?

ii What would be the effect on the value of this bond if the required rate of return increases from to and the coupon is made annually? Show your calculations.

b Describe the advantages and disadvantages of bonds to the issuing firm.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock