Question: A growing chain is trying to decide which store location to open. The first location (A) requires a $500,000 investment in average assets and

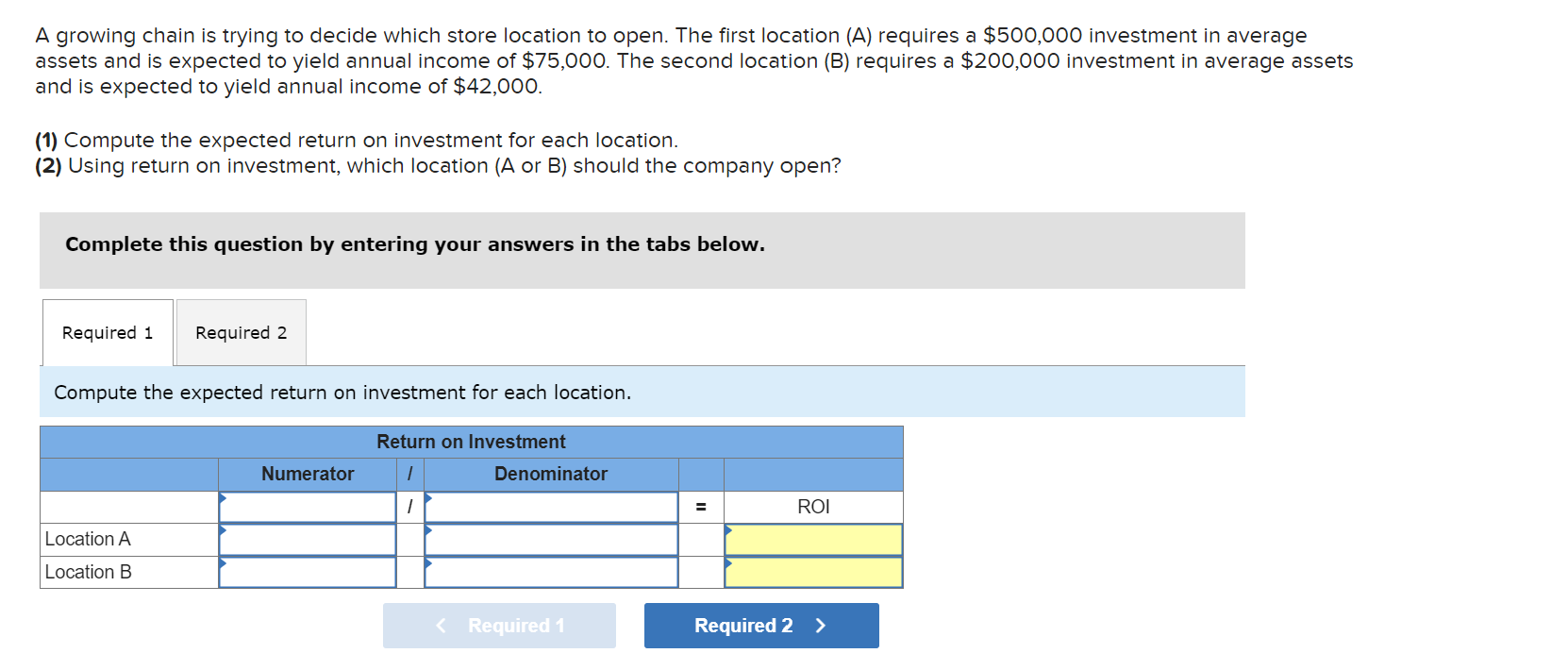

A growing chain is trying to decide which store location to open. The first location (A) requires a $500,000 investment in average assets and is expected to yield annual income of $75,000. The second location (B) requires a $200,000 investment in average assets and is expected to yield annual income of $42,000. (1) Compute the expected return on investment for each location. (2) Using return on investment, which location (A or B) should the company open? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the expected return on investment for each location. Location A Location B Return on Investment Numerator Denominator = ROI < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Required 1 To compute the expected return on investment for e... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663d82d61efec_966055.pdf

180 KBs PDF File

663d82d61efec_966055.docx

120 KBs Word File