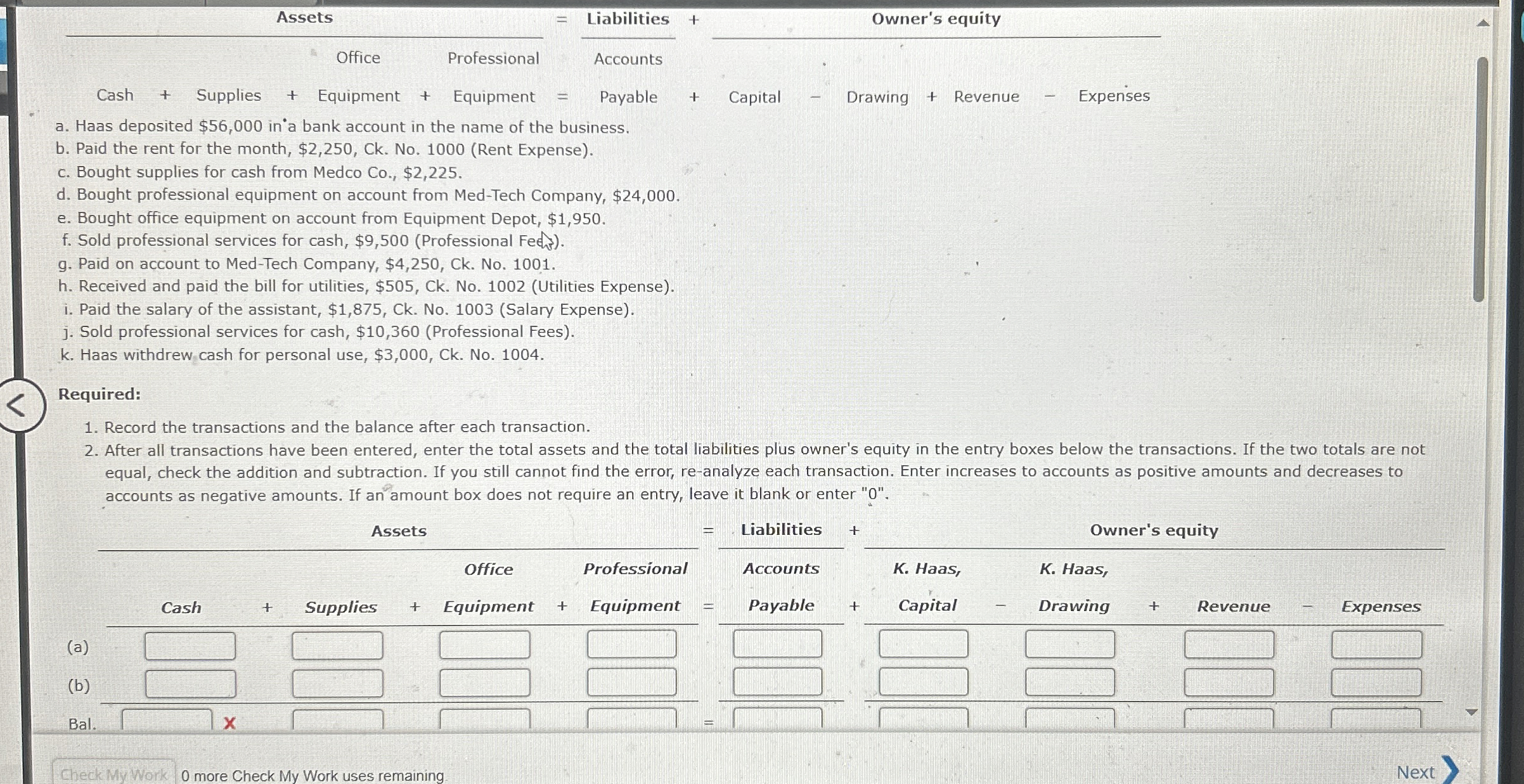

Question: a . Haas deposited $ 5 6 , 0 0 0 in a bank account in the name of the business. b . Paid the

a Haas deposited $ in a bank account in the name of the business.

b Paid the rent for the month, $ Ck NoRent Expense

c Bought supplies for cash from Medco Co $

d Bought professional equipment on account from MedTech Company, $

e Bought office equipment on account from Equipment Depot, $

f Sold professional services for cash, $Professional Fe

g Paid on account to MedTech Company, $ Ck No

h Received and paid the bill for utilities, $ Ck NoUtilities Expense

i Paid the salary of the assistant, $ Ck NoSalary Expense

j Sold professional services for cash, $Professional Fees

k Haas withdrew cash for personal use, $ Ck No

Required:

Record the transactions and the balance after each transaction.

After all transactions have been entered, enter the total assets and the total liabilities plus owner's equity in the entry boxes below the transactions. If the two totals are not

equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction. Enter increases to accounts as positive amounts and decreases to

accounts as negative amounts. If an amount box does not require an entry, leave it blank or enter

In March, K Haas, MD established the Haas Sports Injury Clinic. The clinic's account headings are presented below. Transactions completed during the month of March follow.

a Haas deposited $ in a bank account in the name of the business.

b Paid the rent for the month, $ Ck NoRent Expense

c Bought supplies for cash from Medco Co $

d Bought professional equipment on account from MedTech Company, $

e Bought office equipment on account from Equipment Depot, $

f Sold professional services for cash, $Professional Fees

g Paid on account to MedTech Company, $ Ck No

h Received and paid the bill for utilities, $ Ck NoUtilities Expense

i Paid the salary of the assistant, $ Ck NoSalary Expense

j Sold professional services for cash, $Professional Fees

k Haas withdrew cash for personal use, $ Ck No

Required:

Record the transactions and the balance after each transaction.

After all transactions have been entered, enter the total assets and the total liabilities plus owner's equity in the entry boxes below the transactions. If the two totals are not

equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction. Enter increases to accounts as positive amounts and decreases to

accounts as negative amounts. If an amount box does not require an entry, leave it blank or enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock