Question: (a) Happiness and wellness, a charitable trust registered under section 12A, provides the following information to you with respect to A.Y. 2021-22. Receipts: (i)

![]()

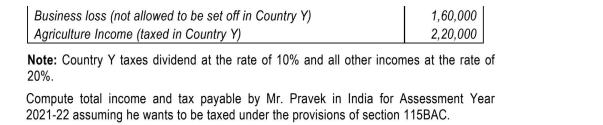

(a) Happiness and wellness, a charitable trust registered under section 12A, provides the following information to you with respect to A.Y. 2021-22. Receipts: (i) Voluntary Contribution received 12,00,000 (ii) Contribution received in a donation box kept outside the office where it is written on the box that the donations received would be utilized for the purpose of construction of building to be used for charitable activities *9,00,000 (iii) Voluntary contribution received from a Non-resident (not included in * 12,00,000 mentioned above) (Date of receipt 29.3.2021) *2,50,000 (iv) Rent received from property held under trust 55,000 per month (v) Grant received from state government (for meeting operational expenses) 3,45,000 Application: (i) Operational expenses towards the objectives of the trust (including *55,000 out of amount accumulated last year) 4,95,000 (ii) Voluntary contribution to another charitable trust having different objects (out of current year receipts) 1,50,000 (iii) Corpus donation to another charitable trust having similar objects (out of current year receipts) 7,50,000 (iv) Voluntary contribution to another charitable trust having similar objects (out of last year receipts) 10,50,000 (v) Income-tax paid (For A.Y. 2020-21) 3,13,000 You are required to compute the total income of the trust for the A.Y. 2021-22. (b) Mr. Pravek (aged 41 years), a sportsman and an individual resident in India, furnishes the following particulars of income earned in India and from Country Y for the Assessment Year 2021-22. India does not have a Double Taxation Avoidance Agreement with Country Y. Amount (3) Particulars Income from India Gross Salary Dividend from Indian companies Income/loss in Country Y Gift in foreign currency from a friend (not taxed in Country Y) Dividend (taxed in Country Y) Total rent from house property in Country Y (taxed in Country Y) Municipal taxes in respect of the above house (Not allowed as deduction in Country Y) 8,40,000 10,50,000 90,000 2,30,000 3,00,000 30,000 Business loss (not allowed to be set off in Country Y) Agriculture Income (taxed in Country Y) 1,60,000 2,20,000 Note: Country Y taxes dividend at the rate of 10% and all other incomes at the rate of 20%. Compute total income and tax payable by Mr. Pravek in India for Assessment Year 2021-22 assuming he wants to be taxed under the provisions of section 115BAC.

Step by Step Solution

3.43 Rating (143 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts