Question: A hedge fund has created a portfolio using just two stocks. It has shorted $32,000,000 worth of Oracle stock and has purchased $89,000,000 of Intel

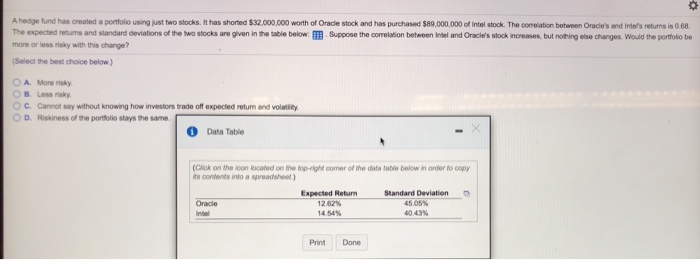

A hedge fund has created a portfolio using just two stocks. It has shorted $32,000,000 worth of Oracle stock and has purchased $89,000,000 of Intel stock. The comeiation between Oracle's and Intel's returns is 0 68 The expected returns and standard deviations of the two stocks are given in the table below: EB. Suppose the correlation between Intel and Oracle's stock increases, but nothing eise changes Would the portolio be more or less risky with this change? (Select the best choice below.) O A. More risky OB. Less risky C Cannot say without knowing how investors trade off expected roturn and volatiity O D. Riskiness of the portolio stays the same. Data Table (Click on the lcon located on the top-right comer of the data table below in order to copy ts contents into a spreadsheet) Expected Return 1262% 14 54% Standard Deviation 45 05% 4043% Oracle Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts