Question: A hedger knows that she will buy 1 million gallons of jet fuel in 3 months. She wants to hedge with forward contracts on heating

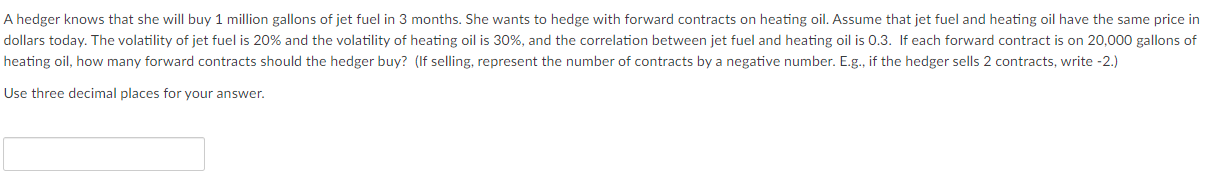

A hedger knows that she will buy 1 million gallons of jet fuel in 3 months. She wants to hedge with forward contracts on heating oil. Assume that jet fuel and heating oil have the same price in dollars today. The volatility of jet fuel is 20% and the volatility of heating oil is 30%, and the correlation between jet fuel and heating oil is 0.3. If each forward contract is on 20,000 gallons of heating oil, how many forward contracts should the hedger buy? (If selling, represent the number of contracts by a negative number. E.g., if the hedger sells 2 contracts, write -2.) Use three decimal places for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts