Question: (a) Highlight is an entity whose functional currency is the dollar ($) and has an annual reporting date of 31 December. On 1 July

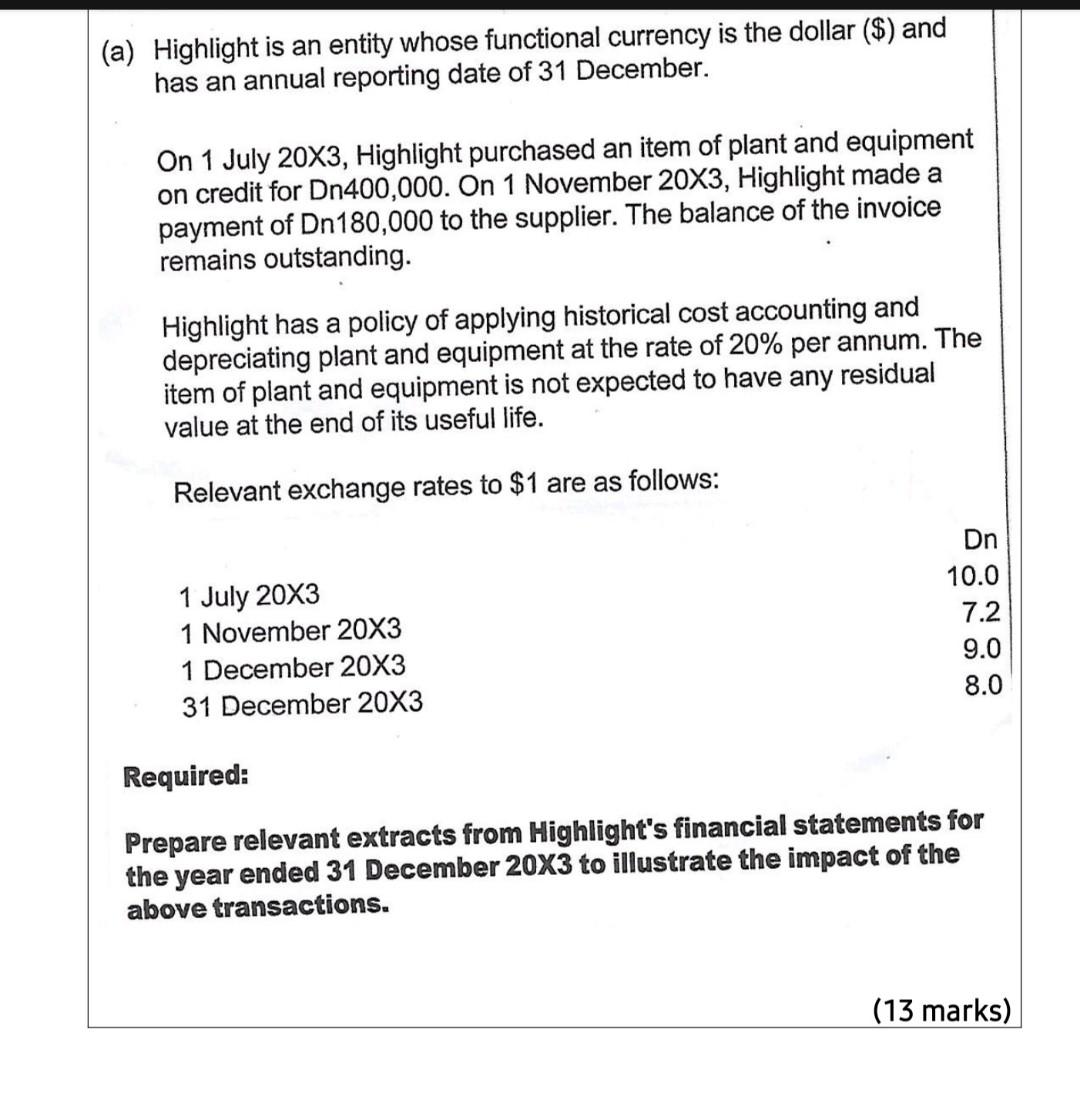

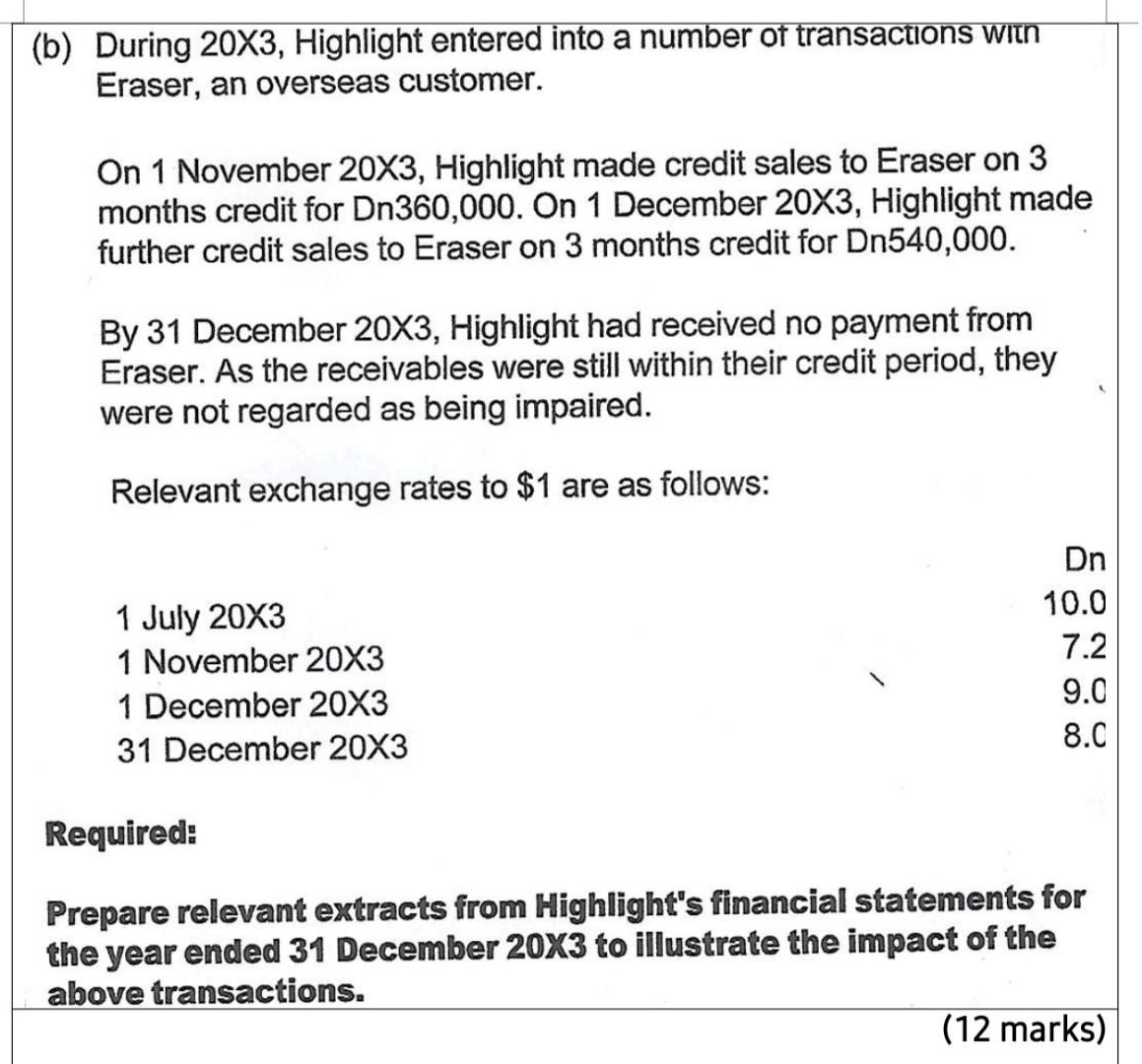

(a) Highlight is an entity whose functional currency is the dollar ($) and has an annual reporting date of 31 December. On 1 July 20X3, Highlight purchased an item of plant and equipment on credit for Dn400,000. On 1 November 20X3, Highlight made a payment of Dn180,000 to the supplier. The balance of the invoice remains outstanding. Highlight has a policy of applying historical cost accounting and depreciating plant and equipment at the rate of 20% per annum. The item of plant and equipment is not expected to have any residual value at the end of its useful life. Relevant exchange rates to $1 are as follows: Dn 1 July 20X3 10.0 1 November 20X3 7.2 1 December 20X3 9.0 31 December 20X3 8.0 Required: Prepare relevant extracts from Highlight's financial statements for the year ended 31 December 20X3 to illustrate the impact of the above transactions. (13 marks) (b) During 20X3, Highlight entered into a number of transactions with Eraser, an overseas customer. On 1 November 20X3, Highlight made credit sales to Eraser on 3 months credit for Dn360,000. On 1 December 20X3, Highlight made further credit sales to Eraser on 3 months credit for Dn540,000. By 31 December 20X3, Highlight had received no payment from Eraser. As the receivables were still within their credit period, they were not regarded as being impaired. Relevant exchange rates to $1 are as follows: Dn 1 July 20X3 10.0 1 November 20X3 7.2 1 December 20X3 9.0 31 December 20X3 8.0 Required: Prepare relevant extracts from Highlight's financial statements for the year ended 31 December 20X3 to illustrate the impact of the above transactions. (12 marks)

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

To address the question you need to prepare relevant extracts from Highlights financial statements f... View full answer

Get step-by-step solutions from verified subject matter experts