Question: A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present time, it can be sold for $25,000 and replaced by

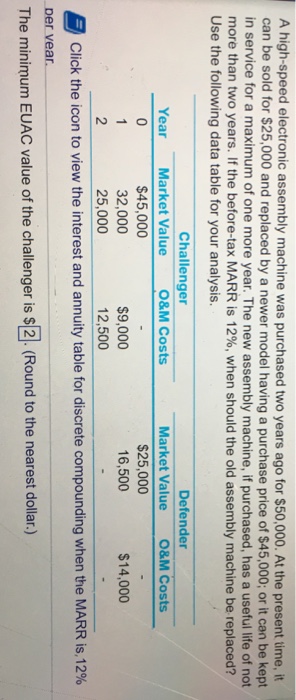

A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present time, it can be sold for $25,000 and replaced by a newer model having a purchase price of $45,000; or it can be kept in service for a maximum of one more year. The new assembly machine, if purchased, has a useful life of not more than two years. If the before-tax MARR is 12%, when should the old assembly machine be replaced? Use the following data table for your analysis. Challenger Market ValueO&M Costs Defender Market Value 0&M Costs Year $45,000 32,000 25,000 9,000 12,500 $25,000 16,500 $14,000 Click the icon to view the interest and annuity table for discrete compounding when the MARR is,12% per vear The minimum EUAC value of the challenger is $2. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts