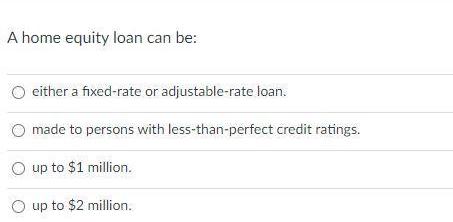

Question: A home equity loan can be: either a fixed-rate or adjustable-rate loan. made to persons with less-than-perfect credit ratings. O up to $1 million.

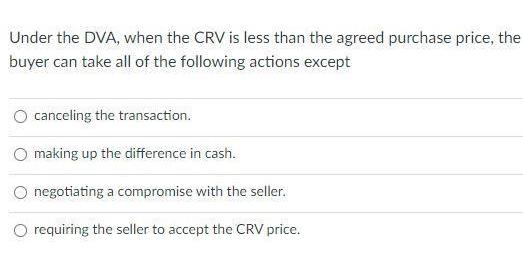

A home equity loan can be: either a fixed-rate or adjustable-rate loan. made to persons with less-than-perfect credit ratings. O up to $1 million. up to $2 million. Under the DVA, when the CRV is less than the agreed purchase price, the buyer can take all of the following actions except canceling the transaction. O making up the difference in cash. negotiating a compromise with the seller. O requiring the seller to accept the CRV price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

The detailed answer for the above question is provided below A home e... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock