Question: A hospital is considering purchasing a new diagnostic machine that is expected to save $250,000 per year for 4 years. The machine costs $800,000.

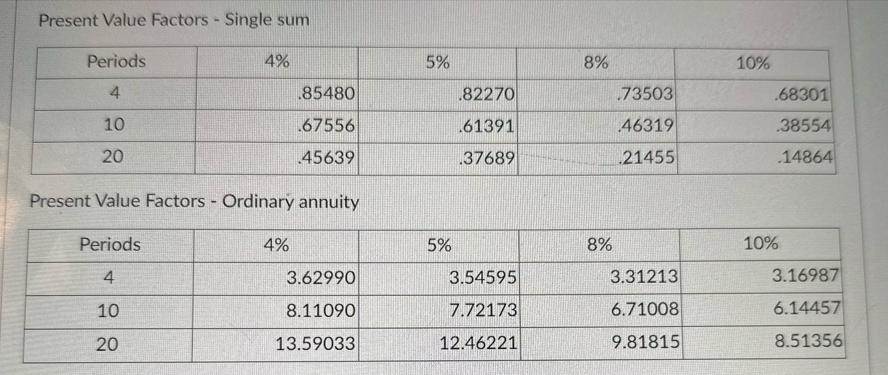

A hospital is considering purchasing a new diagnostic machine that is expected to save $250,000 per year for 4 years. The machine costs $800,000. The hospital has a tax rate of 35 percent and they use straight-line depreciation for tax purposes. Their cost of capital is 8 percent. Calculate the following components of net present value (rounded to the nearest whole dollar). Use a minus sign to express negative numbers. Present value of the initial investment in the machine $ Present value of the savings, net of tax Present Value Factors - Single sum Periods 4 10 20 4% Periods 4 10 20 Present Value Factors - Ordinary annuity .85480 67556 45639 4% 3.62990 8.11090 13.59033 5% 5% .82270 .61391 37689 3.54595 7.72173 12.46221 8% 8% 73503 46319 21455 3.31213 6.71008 9.81815 10% .68301 38554 14864 10% 3.16987 6.14457 8.51356

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

To calculate the components of net present value NPV for the hospitals decision to purchase the diagnostic machine well need to consider the initial investment the savings net of tax and the present v... View full answer

Get step-by-step solutions from verified subject matter experts