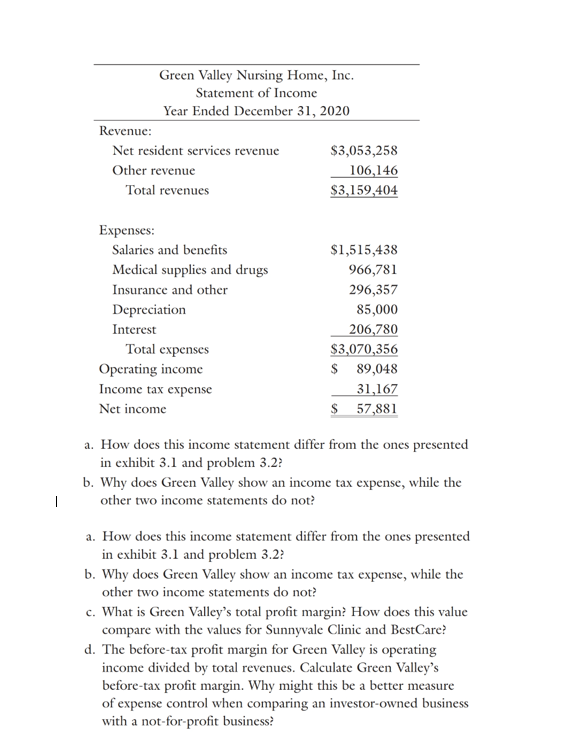

Question: a. How does this income statement differ from the ones presented in exhibit 3.1 and problem 3.2 ? b. Why does Green Valley show an

a. How does this income statement differ from the ones presented in exhibit 3.1 and problem 3.2 ? b. Why does Green Valley show an income tax expense, while the other two income statements do not? a. How does this income statement differ from the ones presented in exhibit 3.1 and problem 3.2? b. Why does Green Valley show an income tax expense, while the other two income statements do not? c. What is Green Valley's total profit margin? How does this value compare with the values for Sunnyvale Clinic and BestCare? d. The before-tax profit margin for Green Valley is operating income divided by total revenues. Calculate Green Valley's before-tax profit margin. Why might this be a better measure of expense control when comparing an investor-owned business with a not-for-profit business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts