Question: a. How many years do you need to wait for the money to double if the interest rates offered is 5% compounded annually? (5

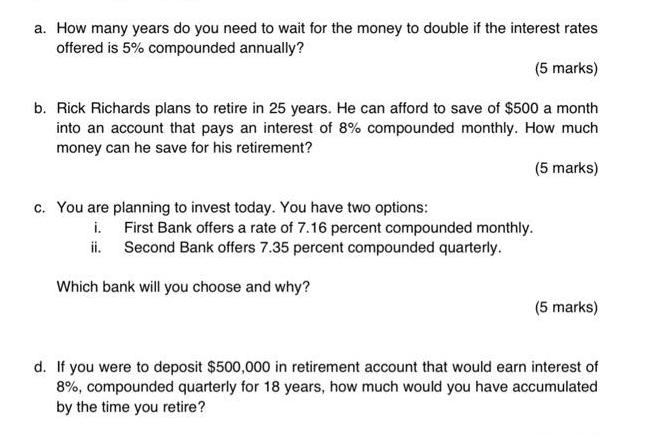

a. How many years do you need to wait for the money to double if the interest rates offered is 5% compounded annually? (5 marks) b. Rick Richards plans to retire in 25 years. He can afford to save of $500 a month into an account that pays an interest of 8% compounded monthly. How much money can he save for his retirement? (5 marks) c. You are planning to invest today. You have two options: i. ii. First Bank offers a rate of 7.16 percent compounded monthly. Second Bank offers 7.35 percent compounded quarterly. Which bank will you choose and why? (5 marks) d. If you were to deposit $500,000 in retirement account that would earn interest of 8%, compounded quarterly for 18 years, how much would you have accumulated by the time you retire?

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts