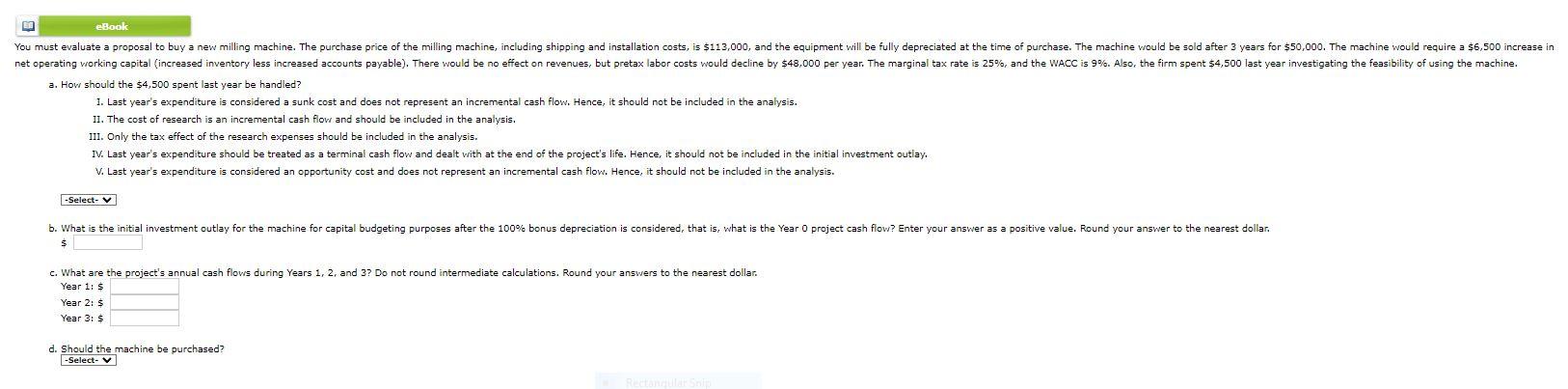

Question: a. How should the $4,500 spent last year be handled? I. Last year's expenditure is considered a sunk cost and does not represent an incremental

a. How should the $4,500 spent last year be handled? I. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. The cost of research is an incremental cash flow and should be included in the analysis. III. Only the tax effect of the research expenses should be included in the analysis. V. Last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts