Question: (a) Identify and explain whether asset beta is appropriate for dividend discount model. (3 marks) (b) Compute the following figures: (i) Sustainable growth rate.(3marks) (ii)

(a) Identify and explain whether asset beta is appropriate for dividend discount model. (3 marks)

(b) Compute the following figures:

(i) Sustainable growth rate.(3marks)

(ii) Appropriate beta. [rounded to 4 decimal places] (3marks)

(iii) Appropriate discount rate.[use the rounded answer in part (ii) and rounded your answer to 4 decimal places] (2 marks)

(iv) Justified value per share. (2marks)

(c)Determine and explain briefly whether Jennifer should buy common stock of CTVB Company. (2 marks)

(d)Identify and explain TWO situations that EV/EBITDA ratio, rather than P/E ratio, is more appropriate for comparing stock value of two profit-making companies in the same industry. (4 marks)

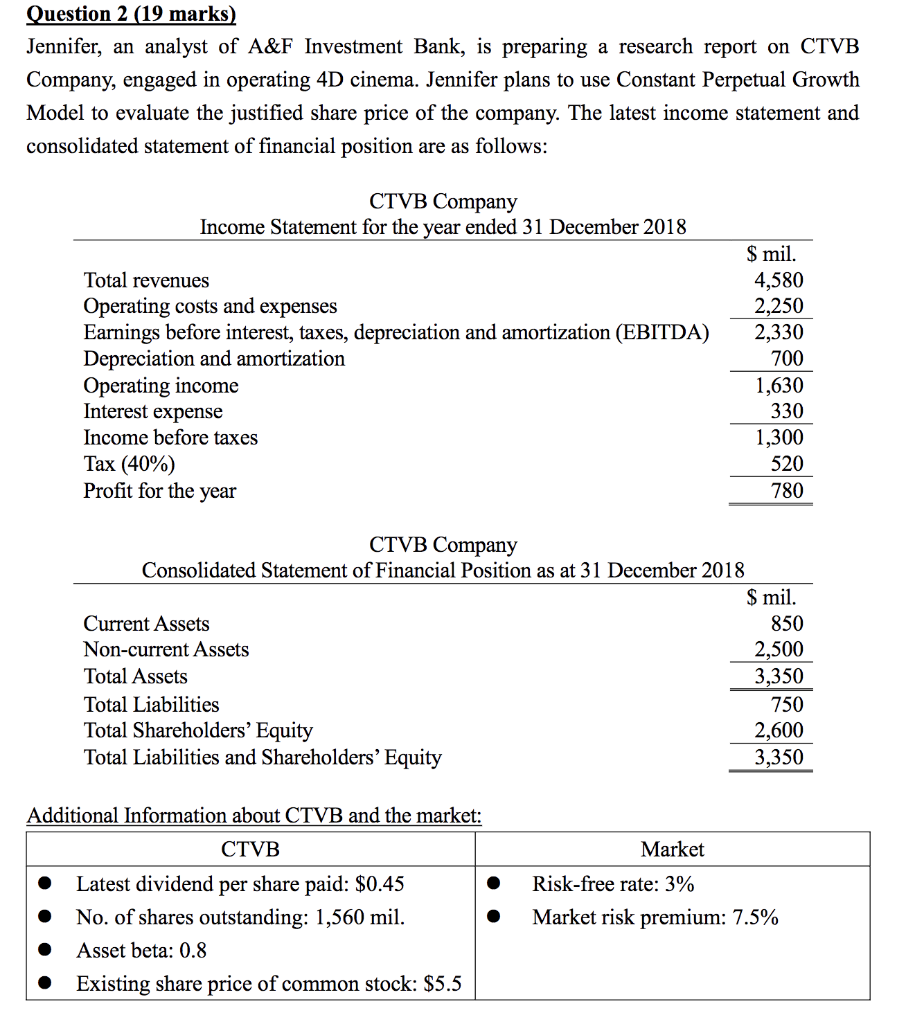

uestion 2 (19 marks) Jennifer, an analyst of A&F Investment Bank, is preparing a research report on CTVB Company, engaged in operating 4D cinema. Jennifer plans to use Constant Perpetual Growth Model to evaluate the justified share price of the company. The latest income statement and consolidated statement of financial position are as follows: CTVB Company Income Statement for the year ended 31 December 2018 S mil. 4,580 2,250 Earnings before interest, taxes, depreciation and amortization (EBITDA)2,330 700 1,630 330 1,300 520 780 Total revenues Operating costs and expenses Depreciation and amortization Operating income Interest expense Income before taxes Tax (40%) Profit for the vear CTVB Company Consolidated Statement of Financial Position as at 31 December 2018 mi Current Assets Non-current Assets Total Assets Total Liabilities Total Shareholders' Equity Total Liabilities and Shareholders' Equity 850 2,500 3,350 750 2,600 3,350 Additional Information about CTVB and the market: CTVB Market O Latest dividend per share paid: $0.45 O No. of shares outstanding: 1,560 mil. O Asset beta: 0.8 O Existing share price of common stock: S5.5 Risk-free rate: 3% Market risk premium: 7.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts