Question: A. If a bank has a negative duration gap, what types of derivatives could they use to counteract the interest rate risks? Explain what type

A. If a bank has a negative duration gap, what types of derivatives could they use to counteract the interest rate risks? Explain what type of interest rate risk they are exposed to (positive or negative) and several different derivative approaches they could use to counteract the risk.

B.  show work

show work

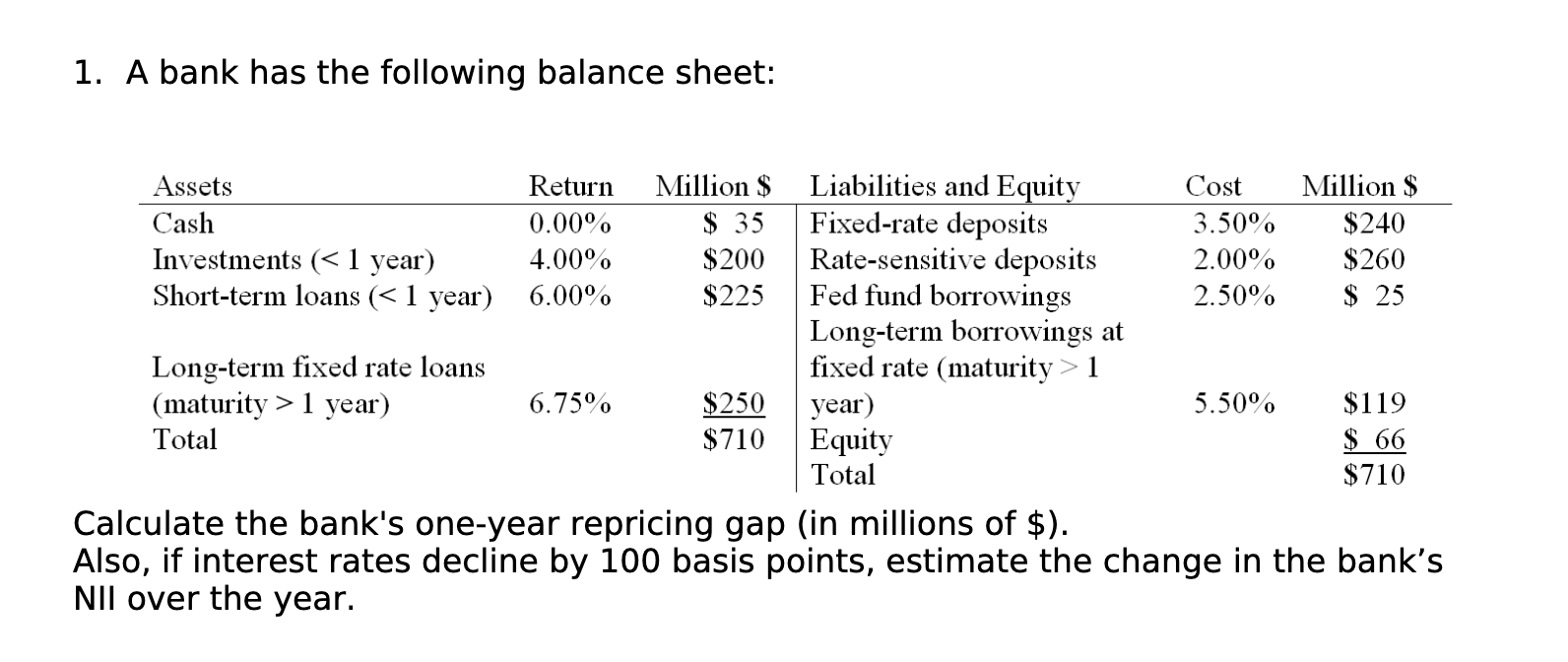

1. A bank has the following balance sheet: Assets Return Million $ Liabilities and Equity Cost Million $ Cash 0.00% $ 35 Fixed-rate deposits 3.50% $240 Investments ( 1 year) 6.75% $250 year) 5.50% $119 Total $710 Equity $ 66 Total $710 Calculate the bank's one-year repricing gap (in millions of $). Also, if interest rates decline by 100 basis points, estimate the change in the bank's NII over the year. 1. A bank has the following balance sheet: Assets Return Million $ Liabilities and Equity Cost Million $ Cash 0.00% $ 35 Fixed-rate deposits 3.50% $240 Investments ( 1 year) 6.75% $250 year) 5.50% $119 Total $710 Equity $ 66 Total $710 Calculate the bank's one-year repricing gap (in millions of $). Also, if interest rates decline by 100 basis points, estimate the change in the bank's NII over the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts