Question: A. If both properties sell at a cap rate (initial cash yield) of 10 percent, what is the expected total return on a 10-year investment

A. If both properties sell at a cap rate (initial cash yield) of 10 percent, what is the expected total return on a 10-year investment in each property?

B. If the 10 percent cap rate represents a fair market value for each property, then which property is the more risky investment? Give reasons for your answer.

C. What is the annual growth rate in operating cash flows for each building during the first 9 years?

D. How is the annual growth rate related to the cap rate and the investor's expected total return (IRR) in each property?

E. In your opinion, which property provides the best investment opportunity and why?

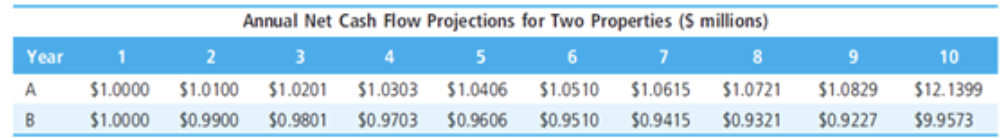

Year 1 9 10 Annual Net Cash Flow Projections for Two Properties (5 millions) 2 3 4 5 6 7 8 $1.0100 $1.0201 $1.0303 $1.0406 $1.0510 $1.0615 $1.0721 $0.9900 $0.9801 $0.9703 $0.9606 $0.9510 $0.9415 $0.9321 A $1.0000 $1.0000 $1.0829 $0.9227 $12.1399 $9.9573 B Year 1 9 10 Annual Net Cash Flow Projections for Two Properties (5 millions) 2 3 4 5 6 7 8 $1.0100 $1.0201 $1.0303 $1.0406 $1.0510 $1.0615 $1.0721 $0.9900 $0.9801 $0.9703 $0.9606 $0.9510 $0.9415 $0.9321 A $1.0000 $1.0000 $1.0829 $0.9227 $12.1399 $9.9573 B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts