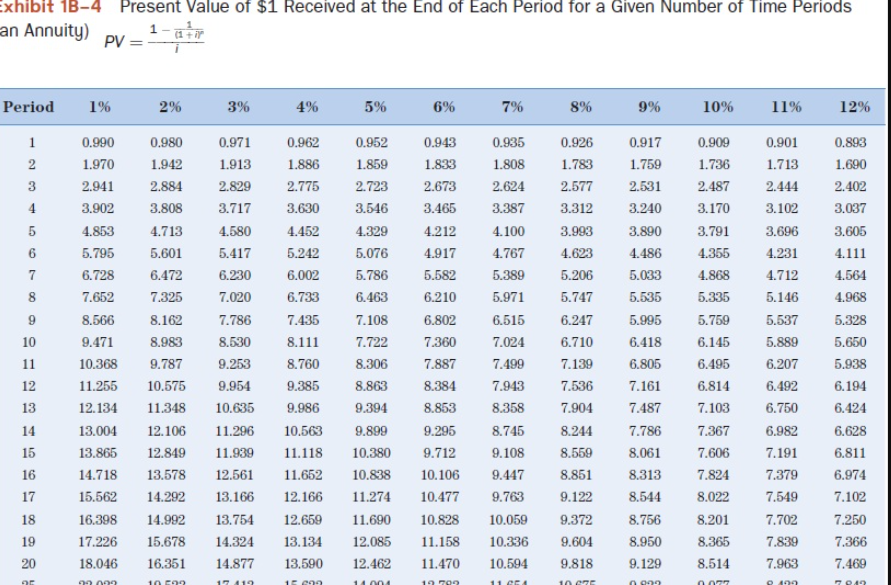

Question: a. If Dave had borrowed $440 for one year at an APR of 7 percent, compounded monthly, what would have been his monthly loan payment?

a. If Dave had borrowed $440 for one year at an APR of 7 percent, compounded monthly, what would have been his monthly loan payment? Use Exhibit 1B-4. (Do not round your intermediate calculations. Round your final answer to 2 decimal places. Omit the "$" sign in your response.) PMT $ b. What would have been the breakdown between interest and principal of the fifth payment? Use Exhibit 1B-4. (Do not round your intermediate calculations. Round your final answers to 2 decimal places. Omit the "$" sign in your response.)

| Interest | $ |

| Principal | $ |

on Period Nude Periods an Annuity PV Period 3 10% ROS OST 1 3 3 0.01 1713 1970 1.93 LP13 1998 1.59 LT . LED 2 ore . 3.17 3516 333 3310 3.170 3.791 3.10 6 4.713 60 26 6.30 231 LT 7 MIRO 6210 4868 3336 TO SIR TI 6. TO 6.45 10 11 19 13 BTS 10575 1135 BO BO 10615 TANT 5.354 TA 2953 994 6.16 6.816 7.105 7.161 . 6184 6. 6.750 12.134 13.004 16 7.06 811 12. 13.578 . 8561 7.101 7:37 14H 10. 11.294 101 102 177 24 151 17 18 RUTE 14 16.07 16:51 11.30 IND 13166 13 754 12 ENT 17415 19.000 8391 5.45 7.700 TS TO 1036 10H 111054 12.40 ILED 12785 IN 100 9.077 TS 12 30 10.700 21.12 4.770 8.000 8.361 9. 2.300 16.12 12 exhibit 1B-4 Present Value of $1 Received at the End of Each Period for a Given Number of Time Periods an Annuity) 1-07 PV Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16,351 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.939 12.561 13.166 13.754 14.324 14.877 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.102 7.250 7.366 7.469 090 10 POO 1119 19 140 1999 11 OR 10 099 no 0400 049

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts