Question: a) If the market expects Genoma's managers to issue equity and undertake the investment independent of the true value of the company, what is

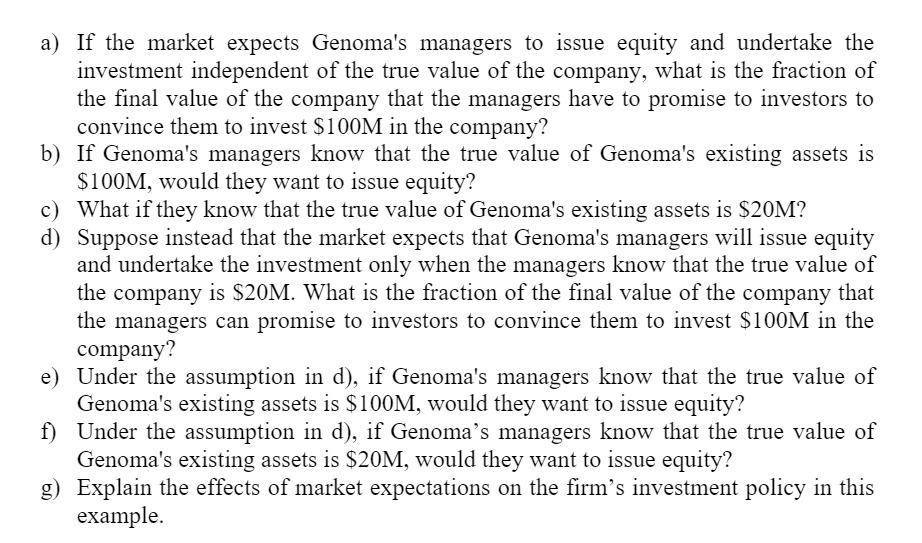

a) If the market expects Genoma's managers to issue equity and undertake the investment independent of the true value of the company, what is the fraction of the final value of the company that the managers have to promise to investors to convince them to invest $100M in the company? b) If Genoma's managers know that the true value of Genoma's existing assets is $100M, would they want to issue equity? d) c) What if they know that the true value of Genoma's existing assets is $20M? Suppose instead that the market expects that Genoma's managers will issue equity and undertake the investment only when the managers know that the true value of the company is $20M. What is the fraction of the final value of the company that the managers can promise to investors to convince them to invest $100M in the company? e) Under the assumption in d), if Genoma's managers know that the true value of Genoma's existing assets is $100M, would they want to issue equity? f) Under the assumption in d), if Genoma's managers know that the true value of Genoma's existing assets is $20M, would they want to issue equity? g) Explain the effects of market expectations on the firm's investment policy in this example.

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

SOLUTION a The fraction of the final value of the company that the managers have to promise to investors to convince them to invest 100M in the company depends on the markets expectations of the manag... View full answer

Get step-by-step solutions from verified subject matter experts