Question: ( a ) . If the required return on a bond differs from its coupon interest rate, describe the behavior of the bond value over

a If the required return on a bond differs from its coupon interest rate, describe the behavior of

the bond value over time as the bond moves toward maturity.

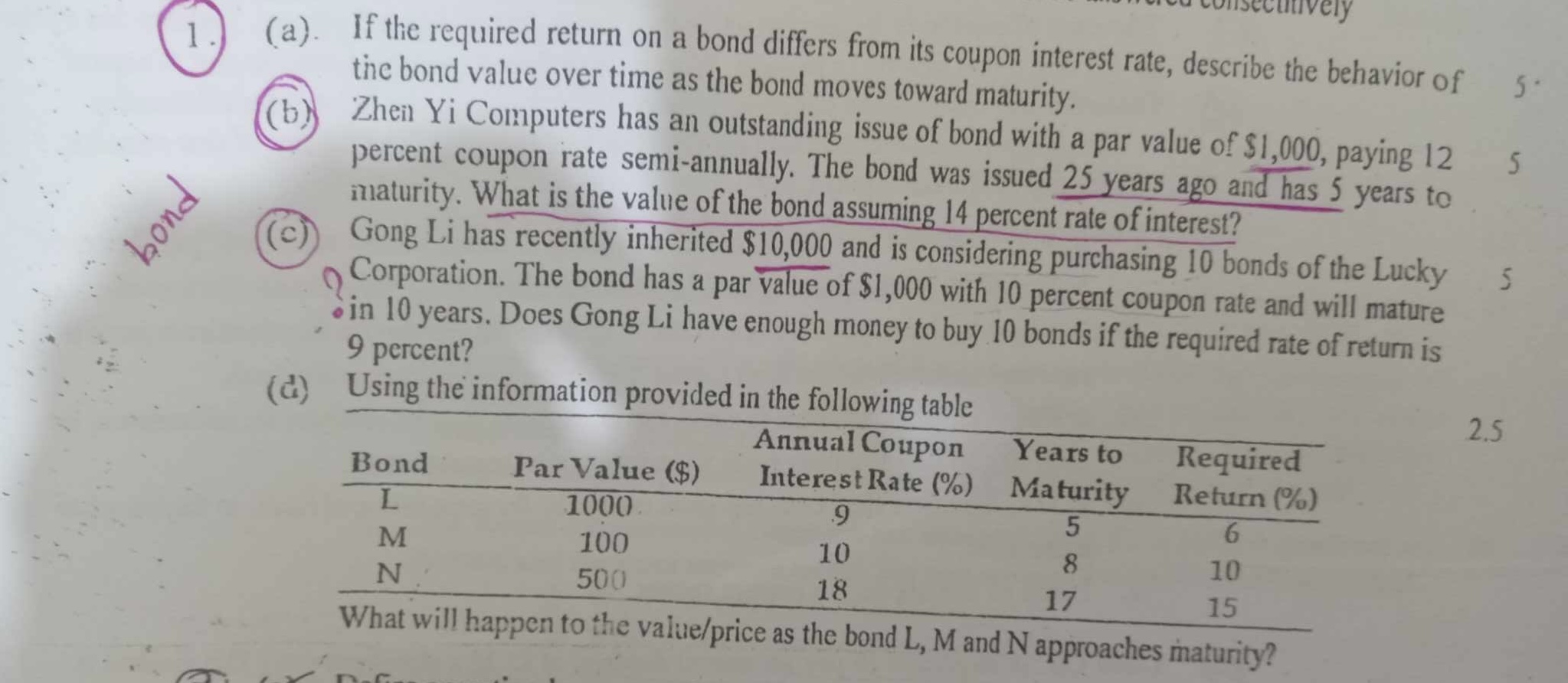

b Zheil Yi Computers has an outstanding issue of bond with a par value of $ paying

percent coupon rate semiannually. The bond was issued years ago and has years to

maturity. What is the value of the bond assuming percent rate of interest?

c Gong Li has recently inherited $ and is considering purchasing bonds of the Lucky

Corporation. The bond has a par value of $ with percent coupon rate and will mature

in years. Does Gong Li have enough money to buy bonds if the required rate of return is

percent?

d Using the information provided in the following table

What will happen to the valueprice as the bond and approaches maturity?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock