Question: (a) In CAPM framework, there are risks that are diversifiable. What are the non-diversifiable risks? (2 marks) (b) See table 1 below. With respect to

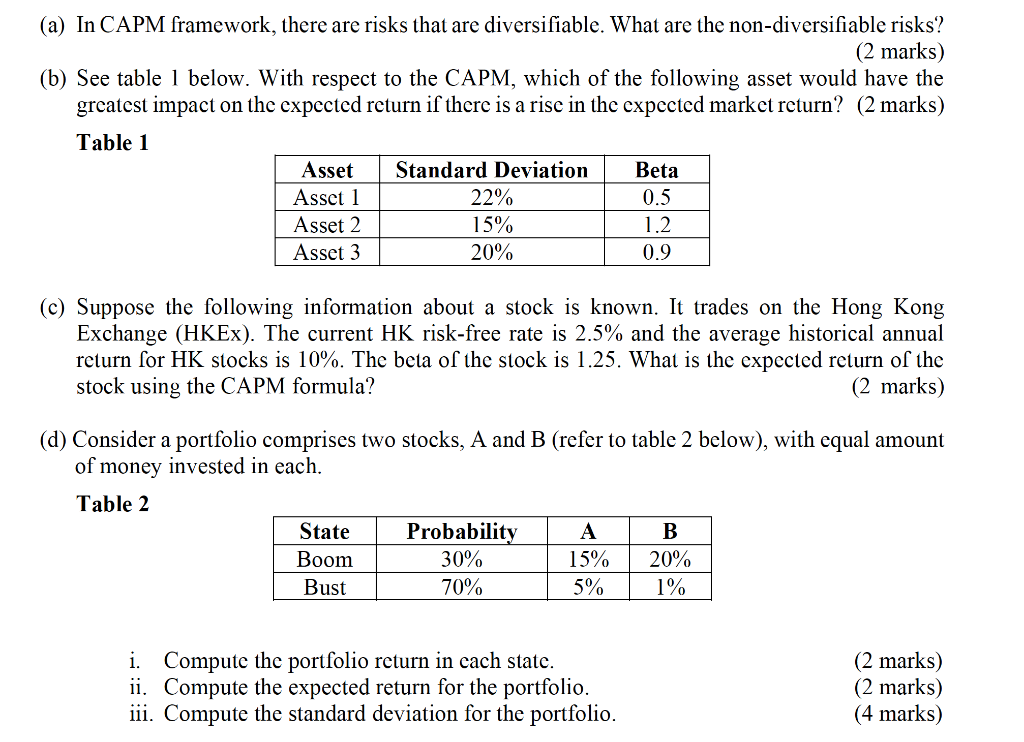

(a) In CAPM framework, there are risks that are diversifiable. What are the non-diversifiable risks? (2 marks) (b) See table 1 below. With respect to the CAPM, which of the following asset would have the greatest impact on the expected return if there is a rise in the expected market return? (2 marks) Table 1 Asset Standard Deviation Beta Asset 1 22% 0.5 Asset 2 15% 1.2 Asset 3 20% 0.9 (c) Suppose the following information about a stock is known. It trades on the Hong Kong Exchange (HKEx). The current HK risk-free rate is 2.5% and the average historical annual return for HK stocks is 10%. The beta of the stock is 1.25. What is the expected return of the stock using the CAPM formula? (2 marks) (d) Consider a portfolio comprises two stocks, A and B (refer to table 2 below), with equal amount of money invested in each. Table 2 State Probability A B Boom 30% 15% 20% Bust 70% 5% 1% i. Compute the portfolio return in each state. ii. Compute the expected return for the portfolio. iii. Compute the standard deviation for the portfolio. (2 marks) (2 marks) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts