Question: (a) In cell B5, input the current date and time, which should be the date and time whenever John examines the spreadsheet. (2 points) (b)

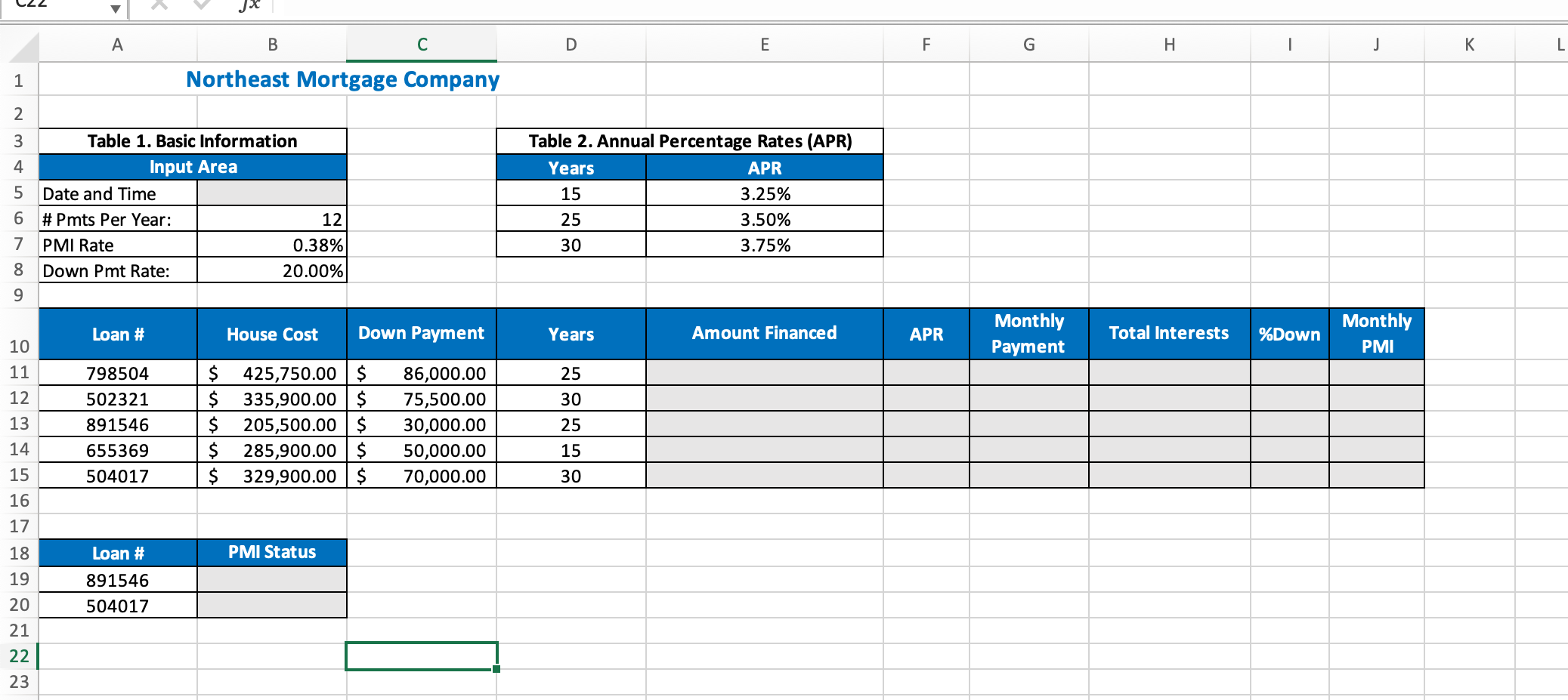

(a) In cell B5, input the current date and time, which should be the date and time whenever John examines the spreadsheet. (2 points) (b) Calculate the amount financed in cell E11:E15. (3 points) (c) The APRs (annual percentage rates) vary based on the number of years to pay off the loan. Table 2 shows the details of APRs when the numbers of years to pay off the loan are 15, 25, and 30. Fill in the cells F11:F15 using any look-up functions. (5 points)

(d) Calculate the monthly payment (use a positive number) in cell G11:G15 (8 points) and the total interests (use a positive number) in H11:H15 (4 points). (e) Calculate the percentage of Down Payment to the House Cost in cell I11:I15. (4 points) (f) Lenders often want borrowers to have a certain percentage down payment. Northeast Mortgage Company requires the borrowers pay at least a 20% down payment, which is shown in cell B8. If borrowers do not put in 20% of the cost of the house as a down payment, then they should pay the private mortgage insurance (PMI) fee. PMI serves to protect lenders from absorbing loss if the borrower defaults on the loan, and it enables borrowers with less cash to secure a loan. The following formula shows how to calculate PMI:

??? = ?????? ???????? (??? ????/???????? ??? ????)

Calculate PMI in cell J11:J15 (5 points). If a person does not need to pay PMI, his/her Monthly PMI should be zero. In cell B19:B20, using Excel functions to figure out the PMI status of certain loan numbers. When the PMI is larger than zero, it should return "Yes", otherwise "No" (8 points).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts