Question: (a) In checking whether several times series, such as monthly exchange rates of various currencies, move together, why do most analysts look at correlations between

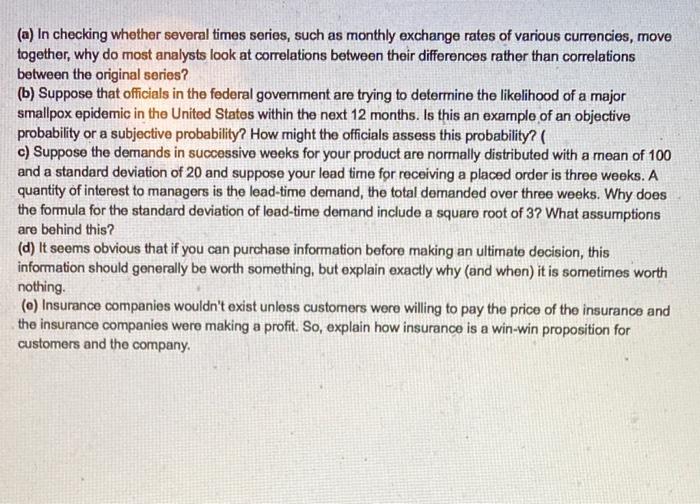

(a) In checking whether several times series, such as monthly exchange rates of various currencies, move together, why do most analysts look at correlations between their differences rather than correlations between the original series? (b) Suppose that officials in the federal government are trying to determine the likelihood of a major smallpox epidemic in the United States within the next 12 months. Is this an example of an objective probability or a subjective probability? How might the officials assess this probability?( c) Suppose the demands in successive weeks for your product are normally distributed with a mean of 100 and a standard deviation of 20 and suppose your lead time for receiving a placed order is three weeks. A quantity of interest to managers is the lead-time demand, the total demanded over three weeks. Why does the formula for the standard deviation of lead-time demand include a square root of 3? What assumptions are behind this? (d) It seems obvious that if you can purchase information before making an ultimate decision, this information should generally be worth something, but explain exactly why (and when) it is sometimes worth nothing. (c) Insurance companies wouldn't exist unless customers were willing to pay the price of the insurance and the insurance companies were making a profit. So, explain how insurance is a win-win proposition for customers and the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts