Question: A. In Graph A: 1. Drawing in and using the Money Supply line/curve, graphically demonstrate the derivation of theMarket Interest rate. 2. Graphically demonstrate what

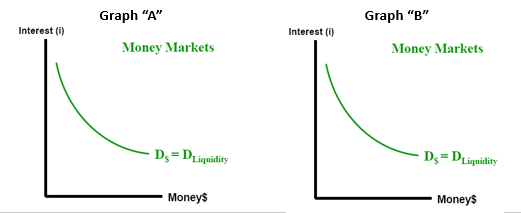

A. In Graph "A":

1. Drawing in and using the Money Supply line/curve, graphically demonstrate the derivation of the"Market Interest" rate.

2. Graphically demonstrate what would happen to Money Supply line/curve as the Fed. Reserve expands excess reserves in the banking system.

3. Graphically demonstrate what would happen to the "Market Interest" rate as this happens.

?

B. In Graph "B":

1. Graphically identify changes in the Demand for Liquidity curve that would likely result from an expanding GDP, an elevation in inflation rate and/or a serious unplanned event in the financial markets.

?

2. What is the most common money supply response of the Federal Reserve Bank to such changes in "Market Interest" rates?

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts