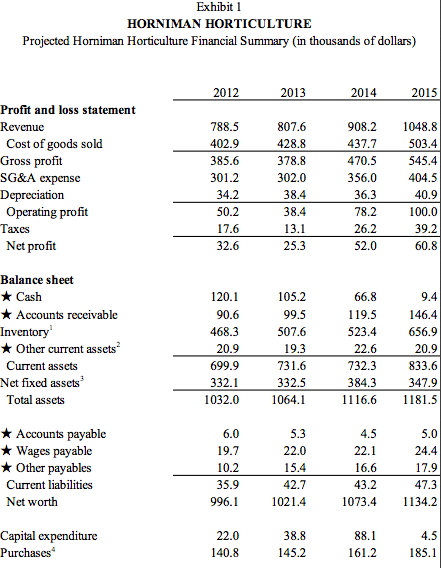

Question: a) In the case, Bob estimates an increase in sales of 30% from 2015 to 2016. Use the Required New Fundsapproach to determine if Horniman

a) In the case, Bob estimates an increase in sales of 30% from 2015 to 2016. Use the Required New Fundsapproach to determine if Horniman Horticulture needs additional funds from the bank to handle this growth. Spontaneous assets and liabilities are noted with a in Exhibit #1

b) Decision? Does Bob need to approach a bank for additional funds to support the anticipated sales growth? If yes how much? If not, why not?

Exhibit 1 HORNIMAN HORTICULTURE Projected Horniman Horticulture Financial Summary (in thousands of dollars) 2012 2013 2014 2015 Profit and loss statement Revenu 788.5 402.9 385.6 301.2 34.2 50.2 17.6 32.6 807.6 428.8 378.8 302.0 38.4 38.4 437.7 470.5 356.0 36.3 78.2 26.2 52.0 908.2 1048.8 503.4 545.4 404.5 40.9 100.0 39.2 60.8 Cost of goods sold Gross profit SG&A expense Depreciation Operating profit laxes Net profit 25.3 Balance sheet Cash 120.1 90.6 468.3 20.9 699.9 332.1 1032.0 105.2 99.5 507.6 19.3 731.6 332.5 1064.1 66.8 119.5 523.4 22.6 732.3 384.3 Accounts receivable Inventory Other current assets Current assets Net fixed assets Total assets 146.4 656.9 20.9 833.6 347.9 116.6 1181.5 * Accounts payable Wages payable * Other payables Current liabilities Net worth 15.4 42.7 1021.4 24.4 17.9 47.3 1073.4 1134.2 22.1 16.6 43.2 35.9 996.1 Capital expenditure Purchases 38.8 145.2 140.8 161.2 185.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts