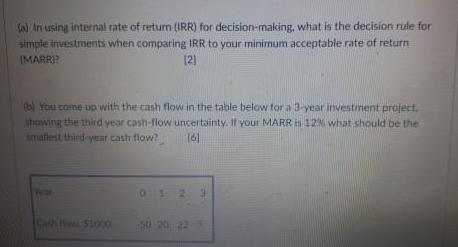

Question: Sa) In using internal rate of return (IRR) for decision-making, what is the decision rule for simpie investments when compating IRR to your minimum

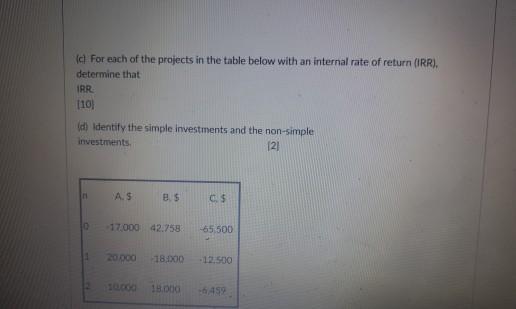

Sa) In using internal rate of return (IRR) for decision-making, what is the decision rule for simpie investments when compating IRR to your minimum acceptable rate of return IMARR? 121 (b) You come up with the cash flow in the table below for a 3-year investiment project. showing the third year cash-flow uncertainty. If your MARR 12N what should be the Smatlest third-year cash flow? 161 0123 50 20 22 (c) For each of the projects in the table below with an internal rate of return (IRR), determine that IRR [10) (d) Identify the simple investments and the non-simple investments. [2] A.S B.S C.S 17.000 42.758 -65,500 20.000 18,000 -12.500 10.000 18.000 6459

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Answer a The Decision Rule for Simple Investments when comparing IRR with ... View full answer

Get step-by-step solutions from verified subject matter experts