Question: a . In what year ( s ) does net income exceed operating cash flows for CVS ? b . In what year ( s

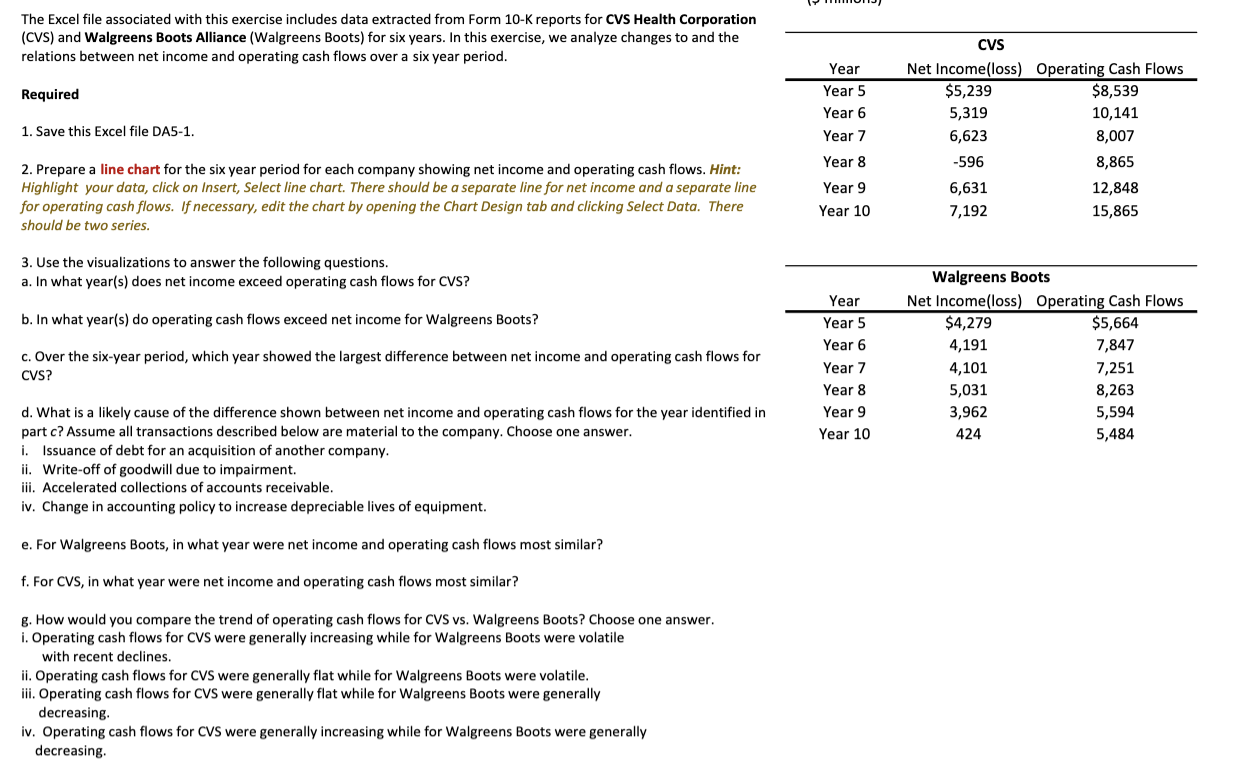

a In what years does net income exceed operating cash flows for CVSb In what years do operating cash flows exceed net income for Walgreens Boots?c Over the sixyear period, which year showed the largest difference between net income and operating cash flows for CVS The Excel file associated with this exercise includes data extracted from Form K reports for CVS Health Corporation CVS and Walgreens Boots Alliance Walgreens Boots for six years. In this exercise, we analyze changes to and the relations between net income and operating cash flows over a six year period.

Required

Save this Excel file DA

Prepare a line chart for the six year period for each company showing net income and operating cash flows. Hint: Highlight your data, click on Insert, Select line chart. There should be a separate line for net income and a separate line for operating cash flows. If necessary, edit the chart by opening the Chart Design tab and clicking Select Data. There should be two series.

Use the visualizations to answer the following questions.

a In what years does net income exceed operating cash flows for CVS

b In what years do operating cash flows exceed net income for Walgreens Boots?

c Over the sixyear period, which year showed the largest difference between net income and operating cash flows for CVS

d What is a likely cause of the difference shown between net income and operating cash flows for the year identified in part c Assume all transactions described below are material to the company. Choose one answer.

i Issuance of debt for an acquisition of another company.

ii Writeoff of goodwill due to impairment.

iii. Accelerated collections of accounts receivable.

iv Change in accounting policy to increase depreciable lives of equipment.

e For Walgreens Boots, in what year were net income and operating cash flows most similar?

f For CVS in what year were net income and operating cash flows most similar?

g How would you compare the trend of operating cash flows for CVS vs Walgreens Boots? Choose one answer.

i Operating cash flows for CVS were generally increasing while for Walgreens Boots were volatile with recent declines.

ii Operating cash flows for CVS were generally flat while for Walgreens Boots were volatile.

iii. Operating cash flows for CVS were generally flat while for Walgreens Boots were generally decreasing.

iv Operating cash flows for CVS were generally increasing while for Walgreens Boots were generally decreasing.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock