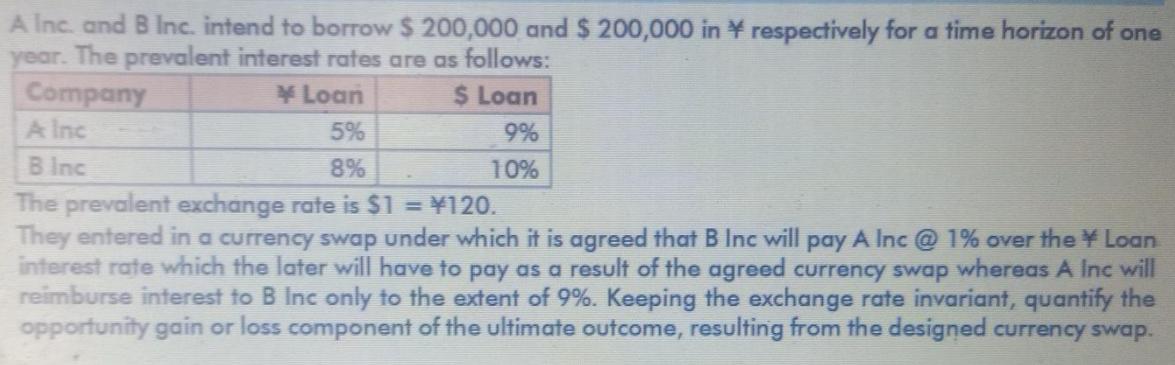

Question: A Inc. and B Inc. intend to borrow $ 200,000 and $ 200,000 in respectively for a time horizon of one year. The prevalent

A Inc. and B Inc. intend to borrow $ 200,000 and $ 200,000 in respectively for a time horizon of one year. The prevalent interest rates are as follows: Company Loan $ Loan A Inc 5% 9% B Inc 8% 10% The prevalent exchange rate is $1 = 120. They entered in a currency swap under which it is agreed that B Inc will pay A Inc @ 1% over the * Loan interest rate which the later will have to pay as a result of the agreed currency swap whereas A Inc will reimburse interest to B Inc only to the extent of 9%. Keeping the exchange rate invariant, quantify the opportunity gain or loss component of the ultimate outcome, resulting from the designed currency swap.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Requirement Loun rate Loan rate 5 BMC Equivalent onow... View full answer

Get step-by-step solutions from verified subject matter experts