Question: a) Inflation, denoted as {Xt}, is a key target variable for monetary policy and if its forecasts are outside the interval [0.5, 3], then we

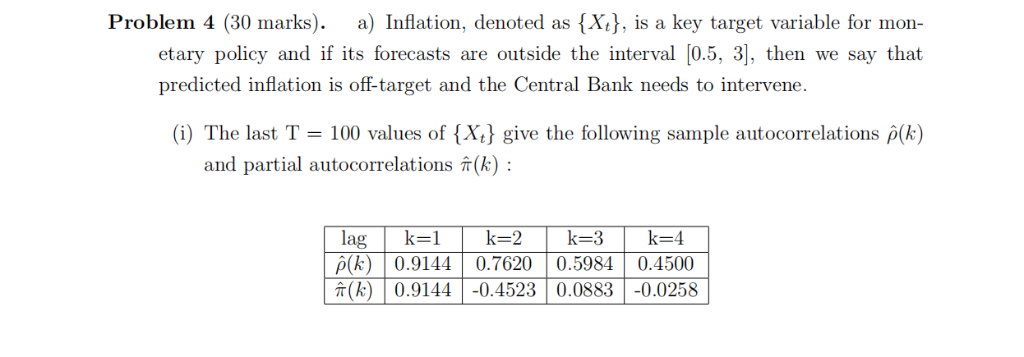

a) Inflation, denoted as {Xt}, is a key target variable for monetary policy and if its forecasts are outside the interval [0.5, 3], then we say that predicted inflation is off-target and the Central Bank needs to intervene.

![policy and if its forecasts are outside the interval [0.5, 3], then](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd454798bfd_37466fd4546efc36.jpg)

Problem 4 (30 marks). a) Inflation, denoted as {Xtj, is a key target variable for mon etary policy and if its forecasts are outside the interval [0.5, 3], then we say that predicted inflation is off-target and the Central Bank needs to intervene. (i) The last T-100 values of {Xi) give the following sample autocorrelations p(k) and partial autocorrelations (k) lag k-1k-2k-3k-4 0.9144 0.76200.5984 0.4500 k) | 0.9144 | -0.4523 | 0.0883 | -0.0258 | The sample mean is -2.0593 and sample variance is | = 2.0658. Using an approximate formula for the 95% confidence intervals for (k) and (k) explain [6 marks] (i) Write an AR(2) model for {X and estimate all its parameters. 12 marks why an AR(2) seems to be a reasonable model for {X, b) The sample used in part a) contains the recent Financial Crisis, therefore, in order to avoid extreme values, a shorter sample is considered. In particular, for the last T-49 values of {X,}, we assume to have the same sample autocorrelations (k) and partial autocorrelations (k) and the same sample mean, X -2.0593, as in part (a.i), but the sample variance is now reduced to -0.6251. Consider again an AR(2) model for [6 marks inflation and estimate again only those parameters that have changed c) Give one reason for preferring the approach in part (a) and one reason for preferring 6 marks] the approach in part (b) Problem 4 (30 marks). a) Inflation, denoted as {Xtj, is a key target variable for mon etary policy and if its forecasts are outside the interval [0.5, 3], then we say that predicted inflation is off-target and the Central Bank needs to intervene. (i) The last T-100 values of {Xi) give the following sample autocorrelations p(k) and partial autocorrelations (k) lag k-1k-2k-3k-4 0.9144 0.76200.5984 0.4500 k) | 0.9144 | -0.4523 | 0.0883 | -0.0258 | The sample mean is -2.0593 and sample variance is | = 2.0658. Using an approximate formula for the 95% confidence intervals for (k) and (k) explain [6 marks] (i) Write an AR(2) model for {X and estimate all its parameters. 12 marks why an AR(2) seems to be a reasonable model for {X, b) The sample used in part a) contains the recent Financial Crisis, therefore, in order to avoid extreme values, a shorter sample is considered. In particular, for the last T-49 values of {X,}, we assume to have the same sample autocorrelations (k) and partial autocorrelations (k) and the same sample mean, X -2.0593, as in part (a.i), but the sample variance is now reduced to -0.6251. Consider again an AR(2) model for [6 marks inflation and estimate again only those parameters that have changed c) Give one reason for preferring the approach in part (a) and one reason for preferring 6 marks] the approach in part (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts