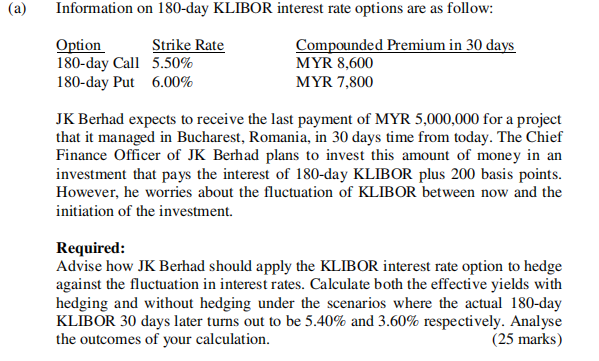

Question: (a) Information on 180-day KLIBOR interest rate options are as follow: Option Strike Rate Compounded Premium in 30 days 180-day Call 5.50% MYR 8,600 180-day

(a) Information on 180-day KLIBOR interest rate options are as follow: Option Strike Rate Compounded Premium in 30 days 180-day Call 5.50% MYR 8,600 180-day Put 6.00% MYR 7,800 JK Berhad expects to receive the last payment of MYR 5,000,000 for a project that it managed in Bucharest, Romania, in 30 days time from today. The Chief Finance Officer of JK Berhad plans to invest this amount of money in an investment that pays the interest of 180-day KLIBOR plus 200 basis points. However, he worries about the fluctuation of KLIBOR between now and the initiation of the investment. Required: Advise how JK Berhad should apply the KLIBOR interest rate option to hedge against the fluctuation in interest rates. Calculate both the effective yields with hedging and without hedging under the scenarios where the actual 180-day KLIBOR 30 days later turns out to be 5.40% and 3.60% respectively. Analyse the outcomes of your calculation. (25 marks) (a) Information on 180-day KLIBOR interest rate options are as follow: Option Strike Rate Compounded Premium in 30 days 180-day Call 5.50% MYR 8,600 180-day Put 6.00% MYR 7,800 JK Berhad expects to receive the last payment of MYR 5,000,000 for a project that it managed in Bucharest, Romania, in 30 days time from today. The Chief Finance Officer of JK Berhad plans to invest this amount of money in an investment that pays the interest of 180-day KLIBOR plus 200 basis points. However, he worries about the fluctuation of KLIBOR between now and the initiation of the investment. Required: Advise how JK Berhad should apply the KLIBOR interest rate option to hedge against the fluctuation in interest rates. Calculate both the effective yields with hedging and without hedging under the scenarios where the actual 180-day KLIBOR 30 days later turns out to be 5.40% and 3.60% respectively. Analyse the outcomes of your calculation. (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts